Natural Gas News – January 27, 2022

Natural Gas News – January 27, 2022

Has The Oil Market Flipped Into Surplus Territory?

The energy sector has continued to defy the broad market selloff in the new year, with seven of Tuesday’s top eight gainers on the S&P 500 being oil and gas stocks, thanks in large part to growing geopolitical tensions. WTI crude for March delivery closed +2.8% to settle at $85.60/bbl after losing 2.2% on Monday, while March Brent crude ended +2.2% at $88.20/bbl. “Tensions are seriously heightened

between Russia and the West, and if there is an invasion of Ukraine when energy markets are already so tight, the additional risk premium should continue to support prices and push it even higher,” Pratibha Thaker at the Economist Intelligence Unit has told MarketWatch. Top gainers were: APA Corp. (NASDAQ:APA) which closed +8.3% to top all major U.S. energy equities; Occidental Petroleum (NYSE:OXY) +8.1%, Halliburton (NY… For more info go to https://bit.ly/34cxaHE

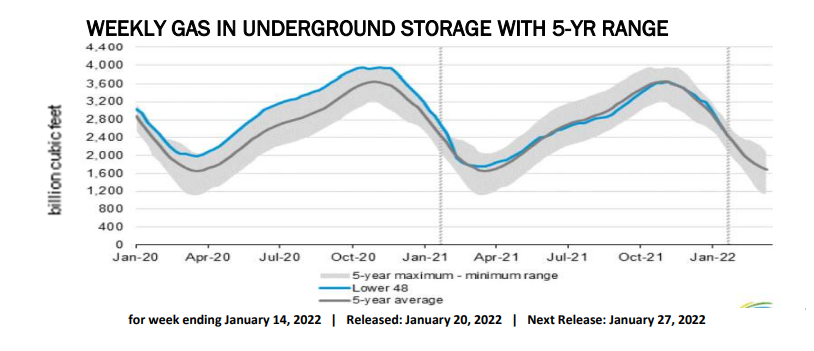

US natural gas storage looks to record largest weekly draw of heating season

US natural gas storage volumes likely registered the largest drop of the season for the week ended Jan. 21, flipping the surplus to the five-year average to a deficit, as an even larger draw is expected for the week in progress due to colder temperatures and production declines. The US Energy Information Administration is expected to report a 214 Bcf withdrawal for the week ended Jan. 21, according to a survey of analysts by S&P Global Platts. Responses to the survey ranged from a 200-227 Bcf withdrawal. The EIA plans to release its weekly storage report on Jan. 27 at 10:30 am ET. A 214 Bcf withdrawal would be more than the five-year average draw of 161 Bcf and the 137 Bcf pull reported during the corresponding week in 2021. It would reduce stocks to 2.596 Tcf. The deficit to last year wou… For more info go to https://bit.ly/3KQNqyy

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.