Oil Hits Two-Week Low: Iran Returns to Negotiations

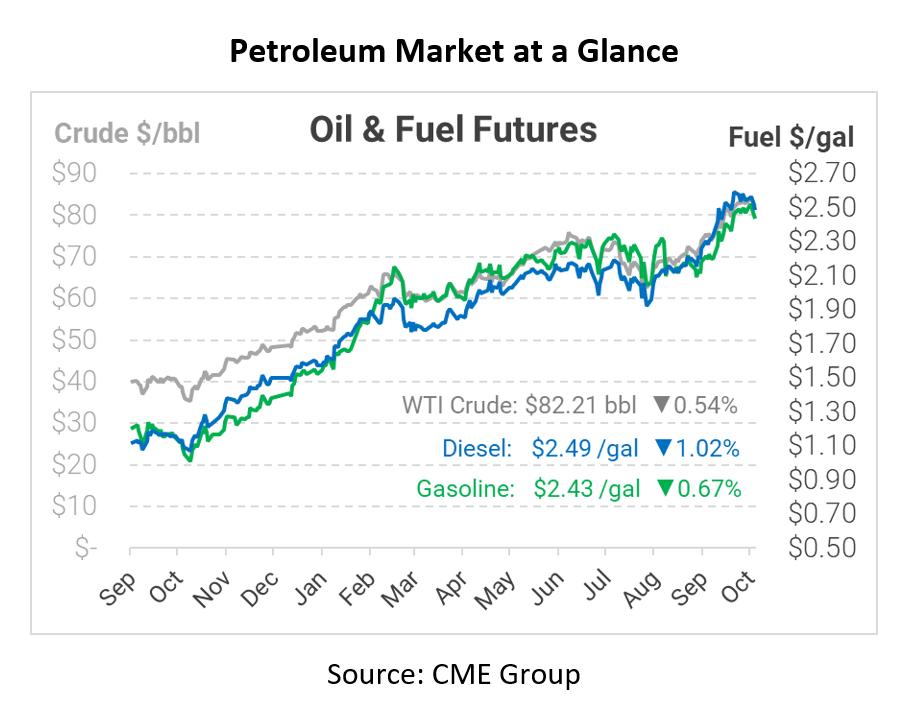

Today oil hit a two-week low, a change of pace from the bullish increase oil has seen over the past few weeks. Lower prices this morning come as a result of the fresh negotiations between Iran and major economies regarding nuclear sanctions. Crude opened the morning at $82.25, diesel at $2.5093, and gasoline at $2.4480.

Yesterday Iran and world leaders met to discuss the future of the resumption of the Iranian nuclear deal. Ali Bagheri Kani, Iran’s top nuclear negotiator, told world leaders that by the end of next month the country would try and “revive” their 2015 nuclear deal that they once had. So far, the US has been notably absent from negotiations, with Iran seeking some type of accord with other global powers.

Along with pulling out of the 2015 nuclear deal, former President Trump imposed strict regulations on Iran during his presidency. Talks between the US and Iran have been off and on, particularly since Iran’s hardline president, Ebrahim Raisi, took office in August. US sanctions have been the most debilitating for the Iranian economy, since they apply to any country or company in the world that does business with Iran. With that in mind, it’s unclear what other major powers can do without the US joining negotiations.

As we have seen today, the prospect of lifting US nuclear sanctions on Iran is bearish for prices, conceivably meaning that there could more supply over time. With Iran controlling nearly 10% of the world’s oil reserves, we should expect to see prices move around in the coming months as a result of talks with Iran. Although talks are resuming, though, it will likely take months for anything concrete to go into effect.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.