Prices Fall, but Forecasters Say Oil Rally Will Continue

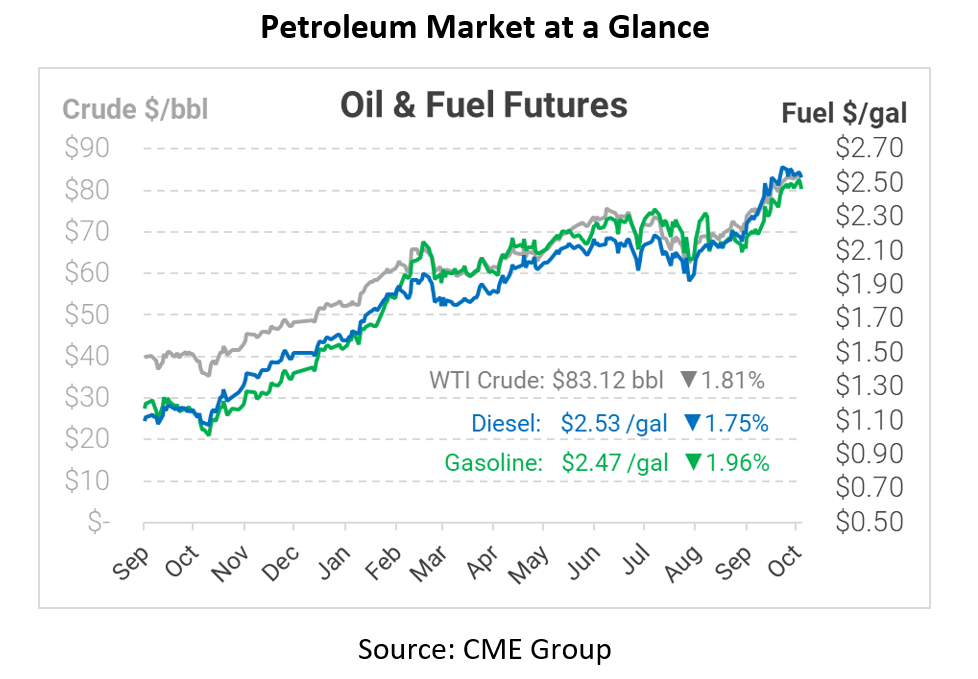

Fuel markets are tumbling this morning thanks to a bearish report from the American Petroleum Institute, which showed US fuel inventories rising more than expected. Crude is down by more than $1.50/bbl this morning, while fuel losses are around 5 cents per gallon.

The API published their weekly inventory data this week, which helped temper prices a bit. Although the market had expected crude inventories to rise, they did not foresee builds for gasoline and diesel stocks. The API’s data is not definitive – markets are awaiting confirmation from the EIA later this morning. Still, comparable data from the EIA may help to cool off a market that has risen 25% in the past two months.

Despite the pullback, forecasters remain bullish. Commerzbank reported that falling crude in Cushing, OK (the largest crude storage hub in the country) is more influential than other builds, suggesting that US crude prices could continue marching higher.

Moreover, RBN Energy reported today that $100 is looking increasingly popular given underinvestment in US crude production. Their report suggests that US output will be capped at 12 MMbpd in 2022, below pre-COVID levels. Oil companies are tearing through their backlog of drilled-but-uncompleted (DUC) wells, which are cheaper and faster to bring into production. Once DUCs are depleted, oil companies will need to rapidly increase rig deployments just to maintain steady production.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.