Natural Gas News – September 28, 2021

Natural Gas News – September 28, 2021

Oil Hits Three-Year High as Natural-Gas Crunch Spills Into Crude Market

A shortfall in global energy supplies spilled into crude markets on Tuesday, pushing oil prices to their highest levels in three years. Brent crude oil, the global benchmark, grazed the $80-a-barrel mark in early trading and was last up 1% at $79.54 a barrel and on course for its highest close since October 2018. U.S. crude futures were up 1.2% at $76.36 a barrel, also on track to close at their highest in three years. Both key benchmarks have jumped around 11% over the past month as part of a broader rally in energy markets, with depleted natural-gas inventories and resurgent economic activity sparking fierce competition in Europe and Asia for natural gas to feed their power markets. “Oil’s move is really to do with the global energy crunch coming out of the gas power market,” said Norbert Rücker, head of economic… For more info go to https://on.wsj.com/3ATNokg

Oil prices at a nearly 3-year high as natural-gas futures jump 11%

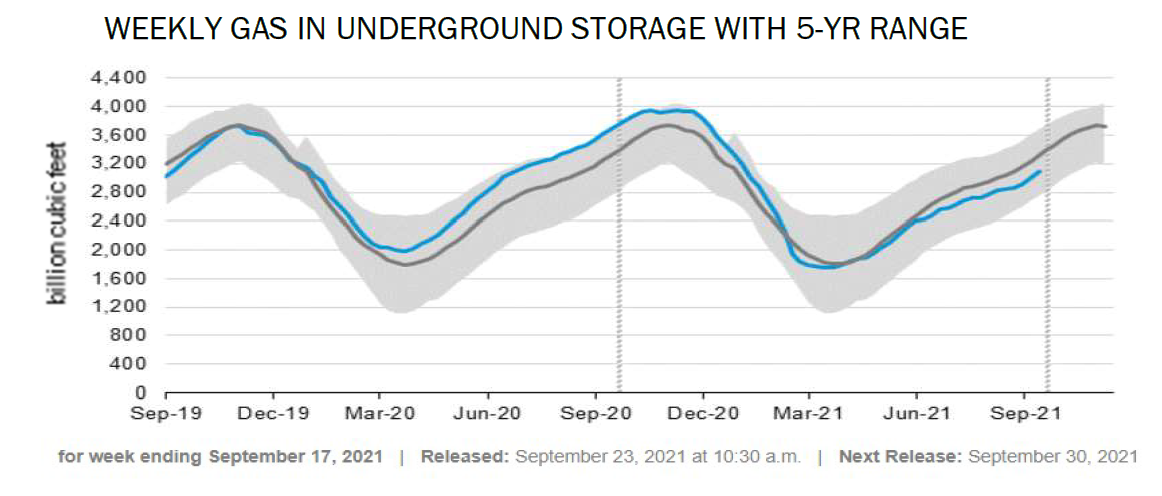

Prices for U.S. and global benchmark crude oil settled Monday at the highest in almost three years, and natural-gas futures rallied back to levels not seen since February 2014, buoyed by tight U.S. supplies and strengthening demand. “Both oil and natural gas are expected to continue higher in the months ahead as fundamentals decidedly favor the bulls right now, while momentum and technicals both point to higher prices in the near to medium term,” said Tyler Richey, co-editor at Sevens Report Research. U.S. crude inventories have fallen sharply in recent weeks due to the lingering impact of Hurricane Ida on energy operations in the Gulf Coast region, he told MarketWatch. For natural gas, weather is almost always the biggest influence and “with expectations for a very cold winter this year, utilities and physical… For more info go to https://on.mktw.net/3AR9d3M

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.