Prices Fall to Lowest in Three Months Over Demand Concerns

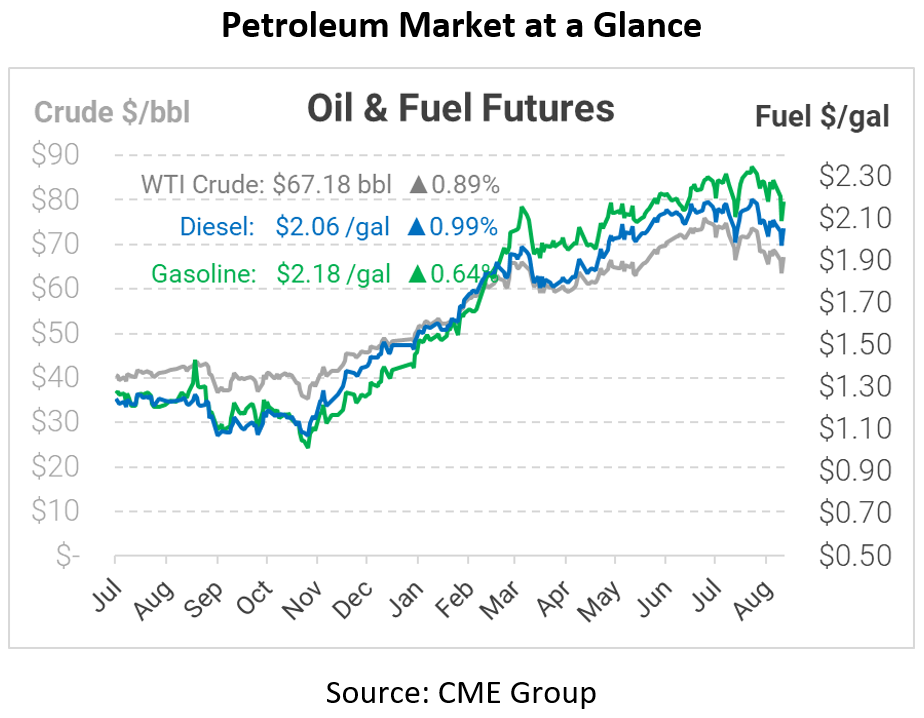

This morning prices fell to their lowest numbers since May, partly due to concerns over weakening demand accompanied by fast-rising COVID-19 cases in the United States. The infection rate, along with rising COVID-19 deaths in the United States and abroad, has once again put the world on notice of a potential massive world lockdown. This morning crude oil opened at $64.58, trading as low as $62.83 at some points. Diesel opened at $2.0019 and gasoline at $2.1294.

While the COVID-19 situation is being carefully watched worldwide, something even more sinister is happening overseas. The Afghanistan situation, with the Taliban taking over the country, continues to worsen. Oil futures markets rely on stability, so instability – especially in the Middle East – will likely slowly trickle down toward investors, who take that worry to the market. “The markets evaluate this as risk, and they add a premium to this, or they could actually use it as a negative premium and force prices down,” said Tim Snyder, Economist at Matador Economics.

The last country to stand between the tension-filled relationship between China and Iran was Afghanistan, which has now been overrun with terrorism. With virtually the entirety of Afghani leadership fleeing the country to seek refuge, the effects of the relationship between China and Iran will now surely be felt in the coming months as it impacts the oil market. COVID-19 and the deteriorating situation in the Middle East are all playing large roles in the oil supply and demand chain and the effects of these situations are just beginning to be felt.

This article is part of Daily Market News & Insights

Tagged: Afghanistan, COVID, Market, Taliban

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.