Two Reasons Fuel Prices Are Down 20 Cents

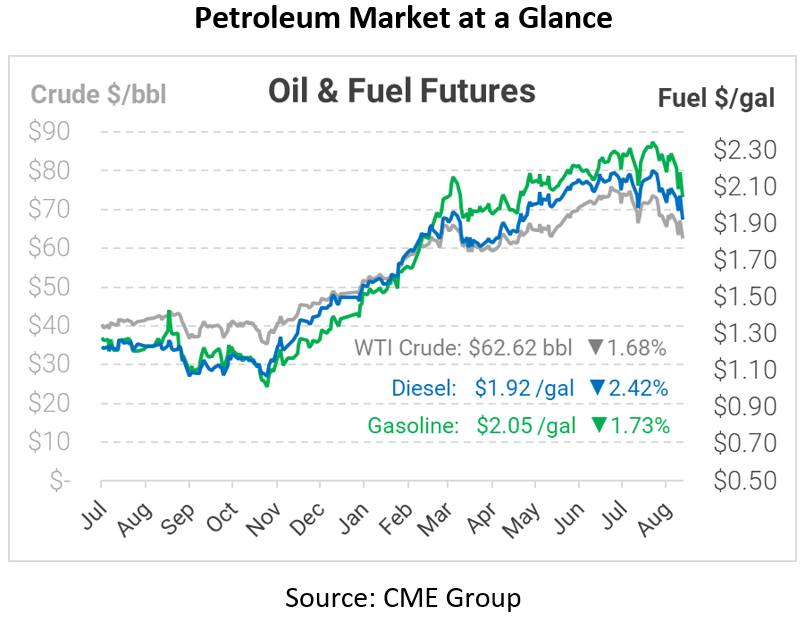

Over the past two weeks, oil prices have collapsed to the lowest point in three months. While observers can clearly attribute bearish sentiment to the spread of the Delta variant, the fundamental supply/demand picture has not changed significantly. So, why the intense selloff this week? Today, we’ll explore two specific reasons why oil prices have fallen.

- Enthusiasm Wains – When crude oil prices roared past $70, it wasn’t because oil markets were tight at the time. Inventories were generally above pre-pandemic levels, and global demand has a long way to go before surpassing normal levels. Traders bid up prices because they anticipated better times ahead. Vaccine rollouts and climbing demand instilled confidence that the world would recover and oil markets would be righted again. The delta variant hasn’t caused a huge demand slump or skyrocketing inventories (so far), but it has sapped confidence in the bounce back. With traders no longer pricing in a huge recovery, prices are falling back to levels more reasonable given today’s fundamentals.

- Federal Reserve Ends Buying Program – On Thursday, minutes from the July Federal Reserve meeting revealed plans to slow the Fed’s bond purchasing program. Bond purchasing is a form of economic stimulus, driving up demand for bonds and injecting money into the economy. The Fed’s decision to slow the program suggests confidence in the US economy, causing the US dollar to rise. Because of the inverse relationship between the US dollar and oil markets, oil markets are sinking as a result.

This article is part of Daily Market News & Insights

Tagged: Bond, Federal Reserve, Oil Market, supply and demand

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.