EIA: Bearish Crude Builds, But Gasoline Demand Near 2019 Levels

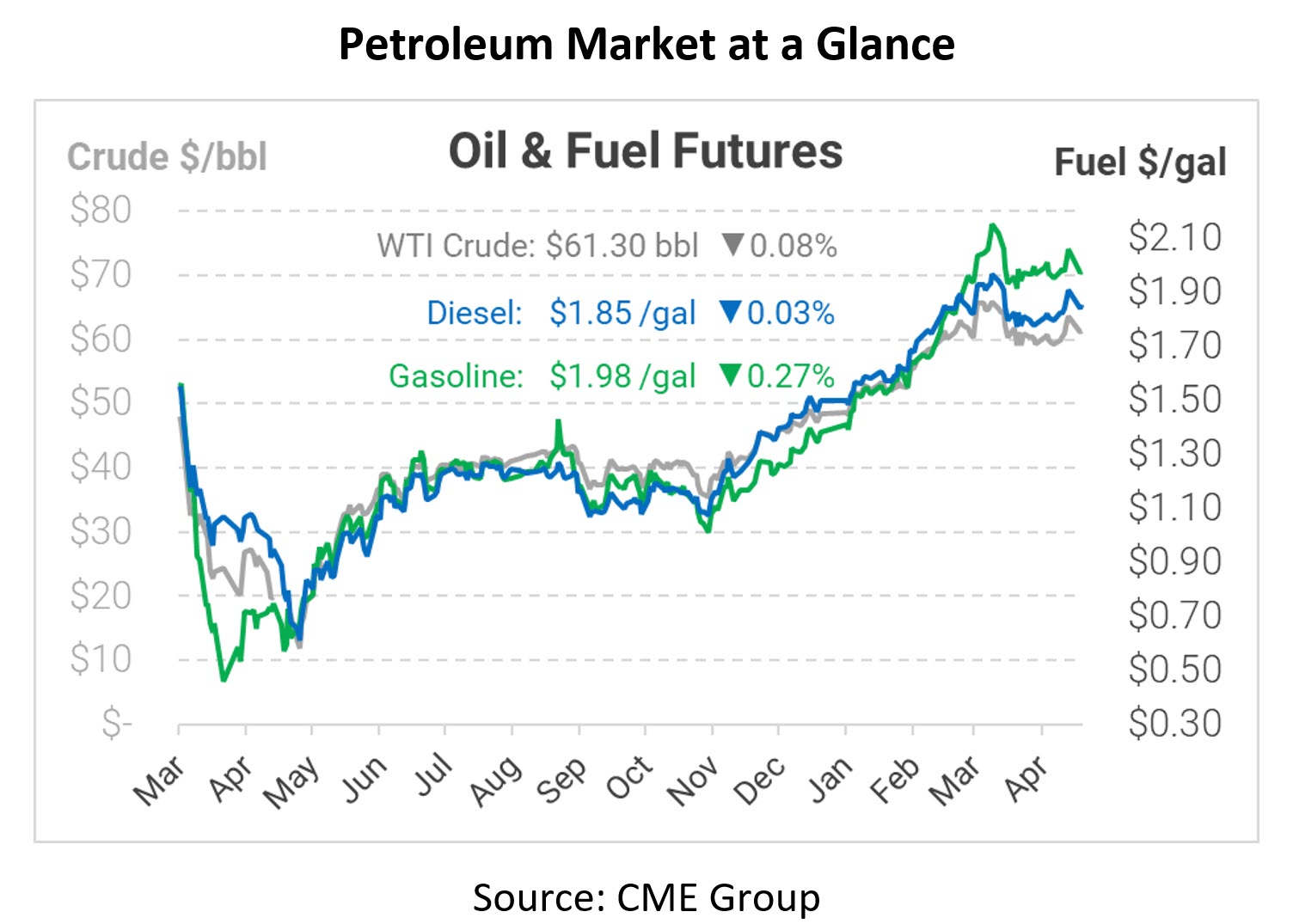

Oil prices moved slightly lower again yesterday, influenced by a surprise crude build that weakened trader sentiments. Positive comments related to US-Iran negotiations, which are happening indirectly in Vienna, are putting downward pressure on the market. The US lifting sanctions on Iran would enable nearly 2 MMbpd of oil to hit global markets, offsetting much of OPEC’s existing cuts.

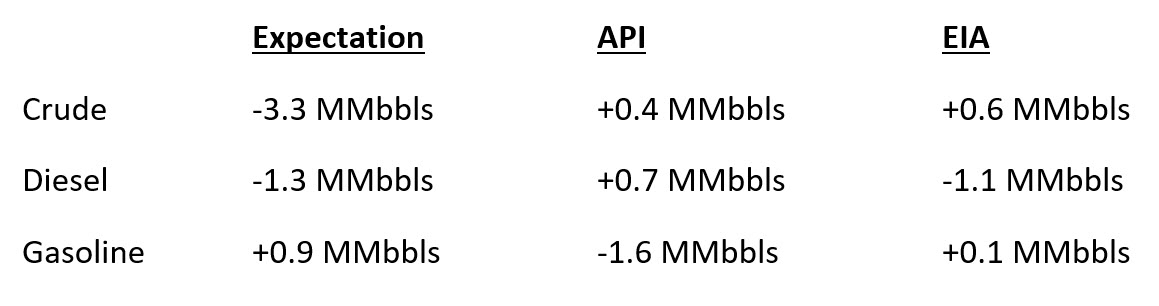

The focal point of the EIA’s report was a moderate crude inventory build, compared to expectations of a sizable draw. Though national crude inventories rose, stocks in Cushing, OK – the delivery point for WTI crude – fell by over a million barrels, moderating oil price losses. On the products side, diesel inventories fell in line with expectations, and gasoline builds were slightly smaller than expected. Notably, gasoline demand was just 3% off from 2019 levels, a strong reading heading into summer driving season.

Despite effective deployments in some countries like the US, other countries remain in the trenches battling COVID-19. India yesterday posted a record 315,000 new cases as the country has been unable to contain outbreaks. Earlier this week, India imposed a six-day lockdown in New Delhi. Japan is expected to declare a state of emergency in Tokyo and Osaka due to rising cases. Both countries are among the top 5 largest oil consumers in the world, so setbacks will undoubtedly impact global oil demand.

This article is part of Daily Market News & Insights

Tagged: COVID, gasoline demand, Inventories, Iran

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.