Oil Prices Retreat on COVID Cases, Reported Crude Build

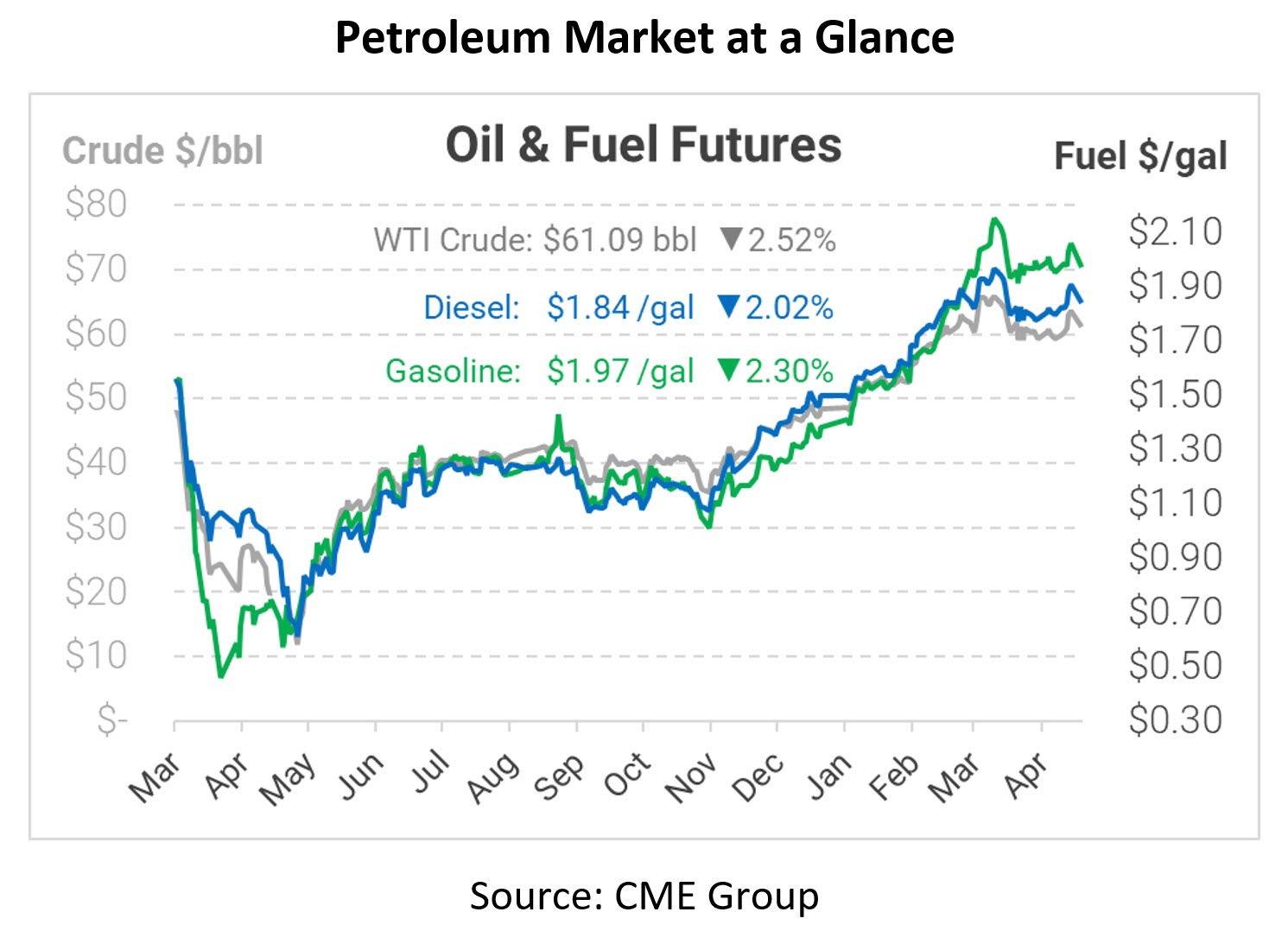

After large losses around midday yesterday, crude oil markets managed to limit losses to just under a dollar, while diesel losses amounted to around a penny. Gasoline was the biggest loser yesterday, seeing prices tumble nearly three cents. Today, losses are continuing, undoing last week’s rally and bringing crude oil back around $61/bbl and sending gasoline below $2/gal. The downward trend doesn’t have a clear catalyst, though there’s still plenty of uncertainty over rising COVID cases in other countries.

The EIA is set to reveal their weekly inventory numbers later today, but prices are weighing the API’s reported crude build in the meantime. If the API is correct, crude oil markets are weaker than expected; a Bloomberg survey shows an expected crude draw of 3.3 million barrels. The API’s data is also bearish for diesel. Gasoline markets showed a small draw, which could add strength to a product that’s been outpacing the markets. The EIA’s data is more comprehensive and definitive than API reporting, so markets will react more strongly later today than they did last night.

Libya remains in the spotlight this week, with nation announcing production cuts. The cuts follow a force majeure announcement declared at their Hariga port, caused by a budgetary dispute with Libya’s central bank. While Libya’s government approved roughly $220 million for oil infrastructure spending, the National Oil Company (NOC) said it has received just 2% of the funds. Without money for repairs, more oil fields will continue to fall offline, the company reported. Libya’s production hit an 8-year high 1.25 million barrels per day last month, but now stands below 1 MMbpd. Marred by years of political instability, Libya’s production was a fraction of current levels as recently as last September, when militias forced the closure of Libya’s major oil fields.

ExxonMobil proposed a hundred-billion dollar carbon storage project that would help oil companies decarbonize their output. The public-private solution would sequester CO2 from petrochemical plants and store them under the Gulf of Mexico. Facing strong shareholder sentiments, Exxon is shifting its resources to more low-carbon projects, aiming to join the green energy movement. According to Exxon, the carbon capture market could be with as much as $2 trillion over the next two decades.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.