Mid-Week Review – January 20, 2021

Saudi’s oil cuts appear prophetic as market risks grow

For Saudi Arabia, bad news in the oil market has rarely been such a vindication. Two weeks ago, the world’s biggest crude exporter stunned energy traders by announcing that — rather than restore halted production as planned — it would slash supplies by a further 1 million barrels a day. The resurgent pandemic necessitated “preemptive” action to protect the oil recovery, said Energy Minister Prince Abdulaziz bin Salman. That ran counter to the view of the kingdom’s OPEC+ ally, Russia, but since then plenty of evidence has emerged that Riyadh made the right call. Click Here to read more from World Oil.

How Joe Biden’s climate plan could affect the oil and gas industry in Texas

President-elect Joe Biden has outlined an ambitious environmental agenda, centered around a goal of “transitioning away” from the fossil fuel industry. His proposals — from adopting tougher methane regulations to incentives for Americans to buy cars that do not run on gasoline — could have an outsized impact in Texas, which produces the most crude oil and natural gas in the country. In some respects, the writing has been on the wall when it comes to the future of environmental policy, and big oil and gas companies were contemplating their role in a net-zero carbon future before Biden’s election. But in Texas, where small, independent operators play a significant role in oil production, Biden’s policies could pack more of a punch. Click Here to read more from the Austin American-Statesman.

U.S. EPA grants three biofuel waivers to refiners before Trump leaves office

The U.S. Environmental Protection Agency (EPA) on Tuesday granted three waivers to oil refiners that exempt them from U.S. biofuel blending obligations, a last-minute move before President Donald Trump leaves office on Wednesday. During his term Trump attempted to find a compromise between two major constituencies, farmers and oil refiners, that disagreed about national requirements to blend biofuels into the fuel mix. Click Here to read more from Reuters.

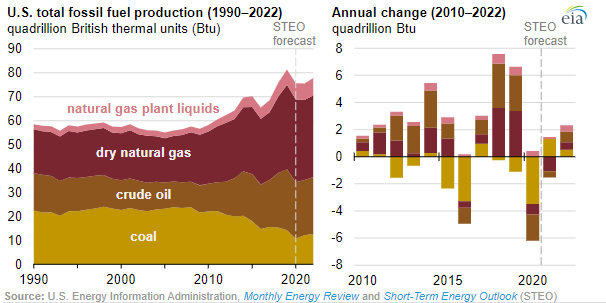

Fossil fuel production to increase through 2022 but remain below 2019 peak

In 2020, fossil fuel production in the United States declined by an estimated 6% from the 2019 record high of 81.3 quadrillion British thermal units (Btu). Based on forecasts in the U.S. Energy Information Administration’s (EIA) January 2021 Short-Term Energy Outlook (STEO), EIA expects total production of fossil fuels in the United States to remain flat in 2021 as increased coal production offsets declines in natural gas production. EIA expects production of all fossil fuels—crude oil, coal, dry natural gas, and natural gas plant liquids (NGPL)—to increase in 2022, but forecast fossil fuel production will remain lower than the 2019 peak. Click Here to read more from the EIA.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.