Biden to Cancel Keystone XL Pipeline

Coming off a long holiday weekend, oil markets are moving moderately higher. Traders are expecting the in-coming Biden administration to act quickly to pass its proposed $1.9 trillion stimulus bill, which would facilitate faster distribution of a vaccine while putting money in people’s hands to spend immediately.

Along with stimulus legislation, Biden is expected to make waves for oil markets immediately. Reports suggest Biden will cancel construction on the 830-kbpd Keystone XL pipeline on his first day, which would force Canadian producers to opt for more crude by rail shipments. Although banning the pipeline won’t eliminate Canadian oil production, it will make shipments slower and less safe. Cancelling the pipeline means less crude flowing to the Gulf Coast from the north, and crude that would have been earmarked for the Chicago region could move south. Since the pipeline is still not operating, the effect won’t be a price increase, but rather will prevent fuel price decreases in the future. It’s also a blow to Canadian producers, who had hoped to export more oil sands crude via the pipeline. Along with the Keystone XL executive order, Biden is expected to re-enter the US into the Paris climate agreement.

The IEA released its Monthly Oil Report for January yesterday, and the agency downgraded Q1 global oil demand by 0.6 MMbpd. The agency’s forecast for 2021 shows strong oil demand in the second half of the year, but OPEC+ will maintain its 5.8 MMbpd cuts. The net result would be an undersupply situation, though the report notes that OPEC+ has been flexible and may tweak its approach to meet the market’s needs. The report maintains a resoundingly bullish tone, noting that “crude prices are well supported by financial, economic and market fundamentals.”

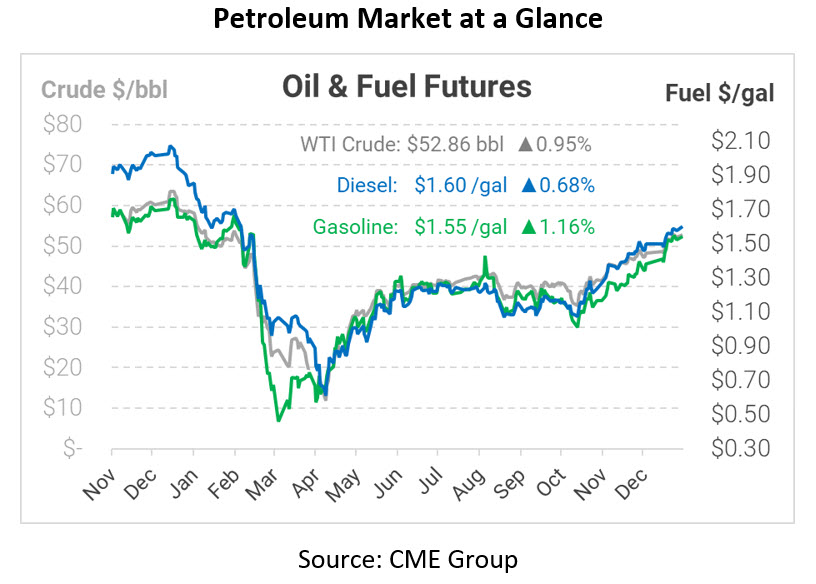

This morning, crude prices are enjoying that tri-fold support. Crude oil is currently trading at $52.86, up 50 cents from Friday’s closing price.

Fuel prices are also getting a gentle boost this morning. Diesel is trading at $1.608, up 1.1 cents (+0.7%) above Friday. Gasoline prices are $1.5461, a gain of 1.8 cents (1.2%).

This article is part of Daily Market News & Insights

Tagged: Biden, IEA, Keystone XL

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.