IEA Downgrades Demand Forecast

WTI crude experienced three straight days of gains this week after news of a vaccine from Pfizer with over 90% effectiveness came to light. The vaccine news built hope for traders in a possible return to normalcy and a world without lockdowns and travel restriction. Traders connected the dots between vaccine success and rising future demand for fuel. Crude is up in early trading this morning even as the IEA announced a downgrade in their demand forecast in their November report.

“We now expect demand to decrease by 8.8 MMbpd in 2020 (versus 8.4 MMbpd in last month’s Report). Vaccines are unlikely to significantly boost demand until well into next year,” the IEA monthly report stated. The 0.4 MMbpd downward revision and warning about vaccines have given traders a reason to pause their rally today. The report went on to discuss supply: “Production from countries participating in the OPEC+ agreement held largely steady. Overall compliance was 103%. In November, world oil supply may rise by over 1 MMbpd as the US recovers from hurricanes and Libya continues to bounce back.” Traders are looking to OPEC to keep the market balanced, and Saudi Arabia, Iraq, and Algeria have recently reiterated their commitment to doing so.

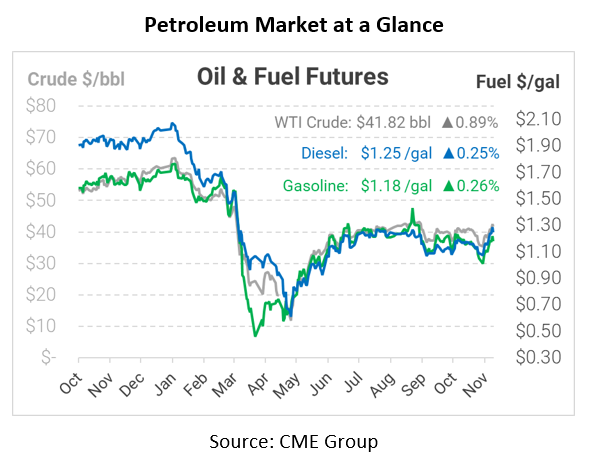

With the Veteran’s Day holiday yesterday, the EIA will report weekly inventory numbers later this morning. Crude prices are up this morning. WTI Crude is trading at $41.82, a gain of 37 cents.

Fuel is relatively flat in early trading this morning. Diesel is trading at $1.2489, a gain of 0.3 cents. Gasoline is trading at $1.1790, an increase of 0.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.