OPEC Revises Demand Forecast and Pledges Support of Market

On Tuesday, WTI crude closed higher continuing gains from the news of a successful coronavirus vaccine. In addition, bullish inventory news and reaffirmations from Saudi Arabia and OPEC of willingness to keep crude markets balanced are helping to lift markets this morning.

In a report from OPEC, they stated that they expect world oil demand to contract by around 9.8 MMbpd for the remainder of this year. That reflects a downward revision of 0.3 MMbpd from last month’s assessment. This revision has traders hopeful that OPEC will take action when they meet at the end of this month by either cutting supply further or continuing current supply cuts next year.

OPEC had originally planned to ease supply cuts in January by 2 MMbpd, but in the face of renewed lockdowns due to the coronavirus and slowing demand globally, OPEC is feeling pressure to act. “As new COVID-19 infection cases continued to rise during October in the US and Europe, forcing governments to re-introduce a number of restrictive measures, various fuels including transportation fuel are thought to bear the brunt going forward,” OPEC said. Yesterday, Saudi Arabia and Iraq released a joint statement saying that they are fully committed to supply cuts to achieve an oil price that is fair to both consumers and producers.

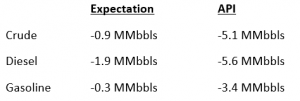

The API’s data last night:

The API reported a large draw for crude of 5.1 MMbbls versus an expected draw of 0.9 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had a decrease. The EIA will report numbers later this morning.

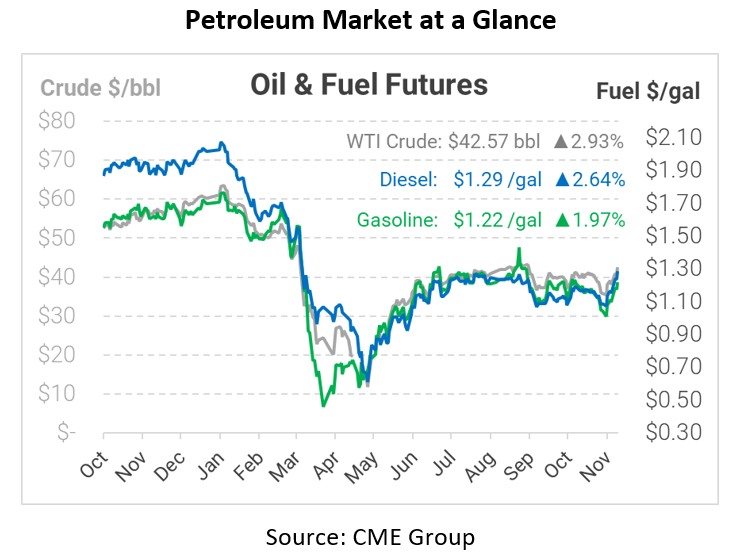

Crude prices are up this morning. WTI Crude is trading at $42.57, a gain of $1.21.

Fuel is up in early trading this morning. Diesel is trading at $1.2856, a gain of 3.3 cents. Gasoline is trading at $1.2176, an increase of 2.4 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.