Natural Gas News – October 12, 2020

Natural Gas News – October 12, 2020

Coal, Nuclear Retirements in US Midwest Might Boost Gas-Fired Power Demand

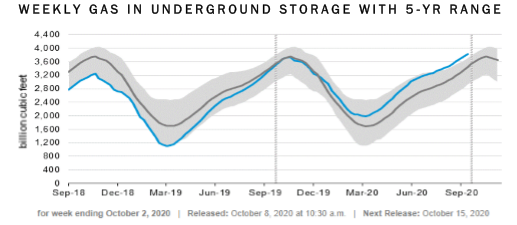

As natural gas storage surpasses five-year maximum levels in the US Midwest, a swath of coal and nuclear power plant retirements look to boost gas’ share of generation winter over winter, help ing balance a towering inventory despite higher hub prices in the region. About 70 MWh of coal-fired capacity has retired since last winter with another 173 MWh offline by the end of this upcoming winter in the Midcontinent Independent System Operator and Southwest Power Pool, according to S&P Global Platts Analytics. This pales in comparison though to the 619 MWh of nuclear generated capacity lost this year. Overall, these losses should provide more opportunity for gas-fired generation in the region. For more on this story visit spgglobal.com or click https://bit.ly/2SJX6Bg

European, Asian Premiums to Aid US LNG Export Recovery by November

Rallying European and Asian natural gas prices have widened premiums to the US Henry Hub since the beginning of September, paving the way for US LNG exports to those regions to return to prepandemic levels this quarter. US LNG exports are forecast to return to pre-coronavirus levels by November, according to the latest energy outlook from the US Energy Information Administration (EIA) released on Wednesday. On the same day the Dutch TTF gas month+2 hit a year-to-date high of $4.865/MMBtu, ICIS assessments show. This resulted in a $1.769/MMBtu premium to the US Henry Hub equivalent, a seven-session high. On the same day the East Asia Index (EAX) month+2 also reached a year-to-date high of $5.55/MMBtu. The contract’s premium to the Henry Hub was $2.454/MMBtu, also a seven-session high. For more on this story visit icis.com or https:// bit.ly/33S99CM.

Natural Gas Price Fundamental Weekly Forecast – LNG, Heating Demand Creating Bullish Conditions

U.S. natural gas futures were on track to hit their highest since November on Tuesday as liquefied natural gas (LNG) exports kee// bit.ly/33S99CMp rising and producers shut Gulf of Mexico wells ahead of Hurricane Delta. That move higher came despite forecasts for milder weather and lower domestic demand over the next two weeks than previously expected. Delta is expected to strengthen into a major hurricane before slamming into the Gulf Coast between Louisiana and Florida on Friday. Front-month gas futures were up 2.5 cents, or 1.0%, at $2.640 per million British thermal units at 8:49 a.m EDT (1249 GMT), putting the contract on track for its highest close since November. For more on this story visit finance.yahoo.com or https://yhoo.it/3lGbXZM.

This article is part of Daily Natural Gas Newsletter

Tagged: gas-fired power, Heating Demand, natural gas, US LNG export

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.