Week in Review – September 11, 2020

WTI crude finished down for the week. The week started with a precipitous drop on news from Saudi Arabia of a cut in price on August Arab Light crude, which traders took as a sign of lowered demand coming out of Asia and especially China.

Crude followed the choppy ride of US equities this week with bearish market news pushing markets lower. The EIA this week lowered the crude forecast for 2021 by 0.5 MMbpd compared to August numbers. This revision came mainly from a downward revision of China’s growth for next year.

In inventory news, draws in gasoline and diesel were outweighed by bearish sentiment from a surprise build in crude. Markets moved lower after the news yesterday and are moving sideways to lower in early trading this morning.

Prices in Review

WTI Crude opened the week at $39.48. It fell to open the shortened trading week then recouped some of those losses then fell again to close the week lower. Crude opened Friday at $37.01, a decrease of $2.47 (-6.3%).

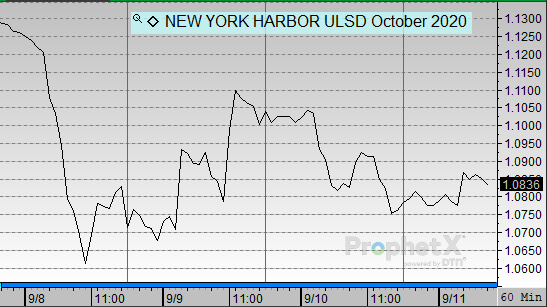

Diesel opened the week at $1.1436. It followed a choppy week of trading to close the week down. Diesel opened Friday at $1.0771 a loss of 6.7 cents (-5.8%).

Gasoline opened the week at $1.1635. It followed a choppy track throughout the week to close the week lower. Gasoline opened Friday at $1.0884, a loss of 7.5 cents (-6.5%).

This article is part of Daily Market News & Insights

Tagged: demand, eia, Refinery Utilization

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.