Natural Gas News – July 30, 2020

Natural Gas News – July 30, 2020

U.S. LNG exports to Europe increase amid declining demand and spot LNG prices in Asia

U.S. exports of liquefied natural gas (LNG) have been growing steadily and reached a new peak of 4.7 billion cubic feet per day (Bcf/d) in May 2019, according to the latest data published by the U.S. Department of Energy’s Office of Fossil Energy. This year, the United States became the world’s third-largest LNG exporter, averaging 4.2 Bcf/d in the first five months of the year, exceeding Malaysia’s LNG exports of 3.6 Bcf/d during the same period. The United States is expected to remain the third-largest LNG exporter in the world, behind Australia and Qatar, in 2019–20. U.S. LNG exports have increased as four new liquefaction units (trains) with a combined capacity of 2.4 Bcf/d—Sabine Pass Train 5, Corpus Christi Trains 1 and

2, and Cameron Train 1—came online since November 2018. Although Asian countries have continued to account for a large share of U.S. LNG exports, shipments to Europe have increased significantly since October 2018 and accounted for almost 40% of U.S. For more on this story visit eia.gov or click https://bit.ly/2CYizSN

Natural Gas ETFs Climb as Summer Heat Fuels Cooling Demand

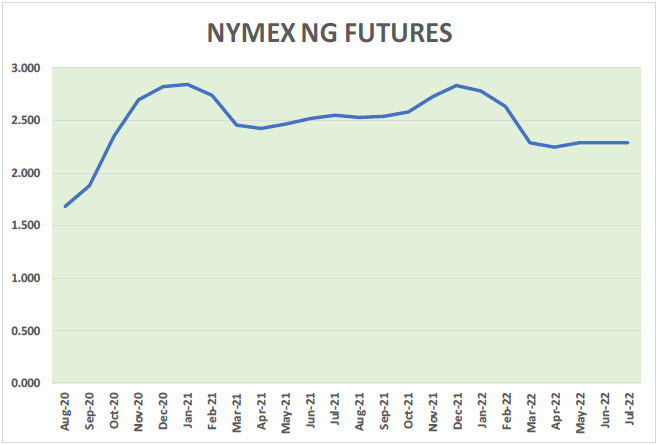

Natural gas-related exchange traded funds led the charge on Thursday as high air cooling demand to counter the summer heat helped support natgas markets. The United States Natural Gas Fund jumped 6.1% on Thursday with Nymex natural gas futures increasing 6.1% to $1.78 per million British thermal units. Natgas prices rallied Thursday, despite a federal report that revealed an expected near-normal storage build. The U.S. Energy Information Administration stated that U.S. utilities injected a near-normal 37 billion cubic feet of gas into storage for the week ended July 17, Reuters reports. For more on this story visit bulletinline.com or https://bit.ly/2CHbfuv

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.