Natural Gas News – July 9, 2020

Natural Gas News – July 9, 2020

Natural Gas Price Fundamental Daily Forecast – Robust Cooling Demand Could Drive Market to $2.00

Exports of natural gas by pipeline are the largest component of U.S. natural gas trade, accounting for 40% of all U.S. gross natural gas exports in 2019. EIA expects these exports to increase with the completion of the southern-most segment of the Wahalajara system, the Villa de Reyes-AguascalientesGuadalajara (VAG) pipeline. VAG began operations in June 2020, connecting new demand markets in Mexico to U.S. natural gas pipeline exports. The Wahalajara system is a group of new pipelines that connects the Waha hub in western Texas, a major supply hub for Permian Basin natural gas producers, to Guadalajara and other population centers in west-central Mexico. The Wahalajara system provides U.S. natural gas to meet growing demand from Mexico’s electric power and industrial sectors. For more on this story visit oilandgas360.com or click https://bit.ly/2Drj3Rl

U.S. Natural Gas Exports to Mexico Set to Rise with Completion of the Wahalajara System

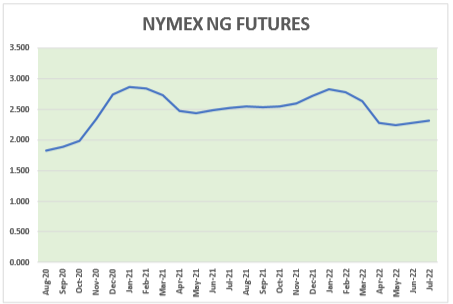

Natural gas futures are trading higher on Tuesday after spiking higher during the previous session. The catalyst behind the move is expectations of robust cooling demand amid a summer heatwave. Some traders said the rally was also fueled by the news that Warren Buffet was buying Dominion Energy. At 06:38 GMT, August natural gas is trading $1.849, up $0.019 or +1.04%. NatGasWeather said, “The weekend weather data was a little cooler trending over the Great Lakes and East next weekend, which looks bearish trending in that view. However, this comes with very hot conditions over Texas, South Plains, and Southwest for this same time period with highs easily in the 100s, thereby, keeping forecast national demand strong.”. For more on this story visit finance.yahoo.com or https://yhoo.it/2O6yvo5.

This article is part of Daily Natural Gas Newsletter

Tagged: natural gas, Wahalajara System

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.