Week in Review – June 12, 2020

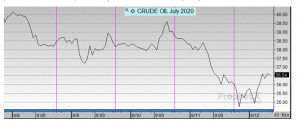

WTI crude opened the week higher on the extension of deep OPEC+ production cuts through July. However, putting a cap on gains was news that the additional reductions by Saudi Arabia and its allies beyond OPEC+ quotas would not be extended. By mid-week, several headlines moved markets lower for the week.

The National Bureau of Economic Research’s Business Cycle Dating Committee announced that the US officially entered a recession in February. Although the label comes as no surprise, it highlights the severe contraction in GDP occurring in the US and around the world.

Bearish EIA data and a gloomy Fed forecast put downward pressure on markets to round out the week. Fed Chairman Jerome Powell stated that the economic future is highly uncertain. He went on to say that the coronavirus could permanently change many parts of the economy, and Fed economists predict unemployment will remain elevated for several years.

After a streak of gains that have brought weekly crude oil prices from $17/bbl in April to nearly $40/bbl last week, it appears the upward streak is coming to a close. Concerns of a second wave of COVID-19 in the US and resulting economic shutdowns is putting broad pressure on financial markets, and oil has not escaped concerns.

Prices in Review

WTI Crude opened the week at $39.41. It had a choppy path to mid-week, where it fell sharply on pessimistic news. Crude opened Friday at $36.26, a loss of $3.15 (-8.0%).

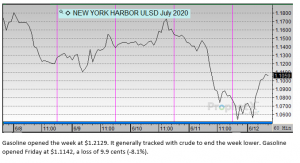

Diesel opened the week at $1.1523. It generally followed crude throughout the week to end lower. Diesel opened Friday at $1.0849, a loss of 6.7 cents (-5.8%).

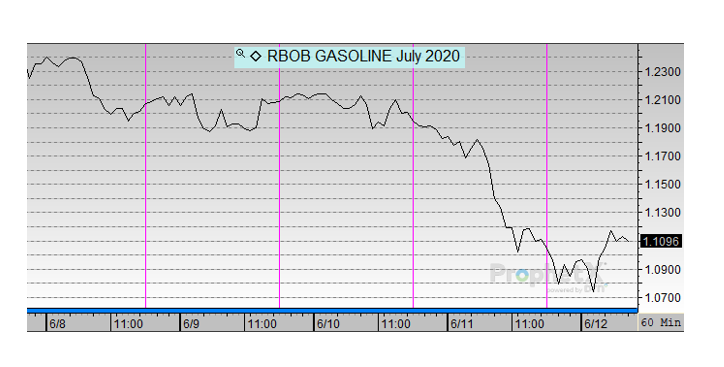

Gasoline opened the week at $1.2129. It generally tracked with crude to end the week lower. Gasoline opened Friday at $1.1142, a loss of 9.9 cents (-8.1%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.