Second Wave Causes Sell-Off, EIA Maintains Bearish Outlook

Markets are stabilizing this morning after heavy losses spread throughout financial markets. Crude oil fell by over 8%, while the Dow Jones Industrial Average dropped by nearly 7%. Behind the sell-off is a rising COVID-19 incident count in many states, which could lead to a second round of lockdowns in the future. On the positive side, rising incident counts are a direct result of increased testing, and in states like Florida the death count has been falling even as positive tests rise. But models based on pneumonia seasonality suggest that fall/winter may bring an uptick in mortality, forcing states to take drastic action.

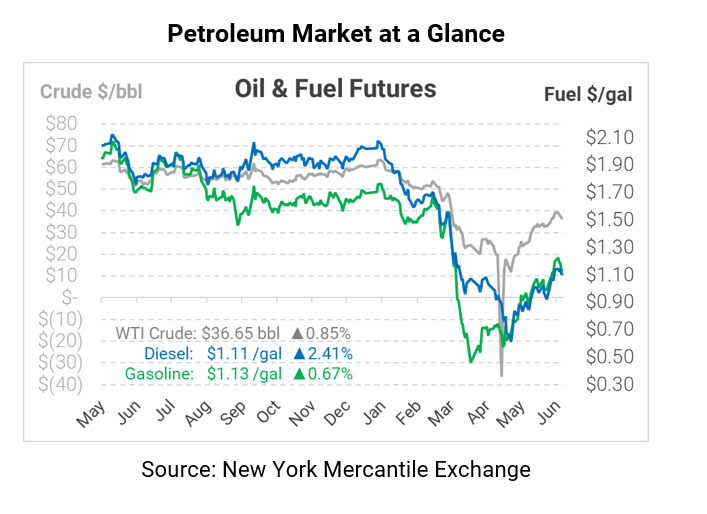

Earlier this week, the EIA released its monthly Short-Term Energy Outlook, which provides a detailed analysis of energy market trends. The agency raised its crude oil price forecast slightly from its May forecast, projecting $35/bbl average prices in 2020. The agency still does not expect WTI crude to average $40/bbl until April 2021, and prices will not average $50/bbl until December 2021. The recent pull-back from the $40/bbl threshold suggests there may be some truth to the bearish forecast; time will tell how the economy recovers and the impact on oil markets.

The group also downgraded its supply and demand forecast for the future. Last month, the agency was predicting a V-shaped recovery – a large drop in demand, but an eventual return to on-trend growth. The latest report now shows the same drop, but the recovery takes far longer to return to 2019 levels. The EIA expects demand to remain around 95 MMbpd, a 5-6% drop from 2019, in Q3 2020, rising just slightly in Q4. Global oil demand is expected to not surpass 100 MMbpd until Q3 2021.

Oil markets are making small gains this morning after the heavy sell-off yesterday. Crude oil is trading at $36.65, up 31 cents from Thursday’s closing price.

Gasoline and diesel price spreads are narrowing, with the products trading just 1.2 cents apart from each other. A second wave of COVID-19 threatens consumer demand, causing gasoline demand to fall more than diesel demand. Today, gasoline prices are trading at $1.1263, up a meager 0.8 cents after shedding almost 9 cents yesterday. Diesel prices are currently $1.1131, up 2.6 cents today after losing 8.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.