Airlines Welcome Uptick in Demand

On Tuesday, WTI Crude finished a quiet day up about 50 cents to close out the June contract with gains on the books. Oil prices have been on an upward trend for the past three weeks – spurred by increasing demand and OPEC+ production cuts. This morning we are seeing prices lifted by a bullish API inventory report.

Crude prices are rising partially due to an uptick in demand for air travel. All the major US carriers are seeing a rise in demand for flights as the fear of the pandemic lessens. While only a modest improvement, any good news is welcomed by the airlines which had experienced nearly zero demand for several months. Carriers such as Delta are planning more flights to ensure the planes remain less than 60% full to convey to passengers a sense of security. Delta want to ensure passengers feel safe to fly again as coronavirus fears remain and social distancing becomes the new normal.

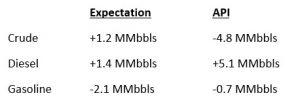

The API’s data last night:

The API reported a surprise draw for crude of 4.8 MMbbls versus an expected build of 1.2 MMbbls. At Cushing, stocks drew by 5.0 MMbbls. The API reported that gasoline had a smaller-than-expected draw, and distillates had a larger-than-expected increase. The EIA will report numbers later this morning.

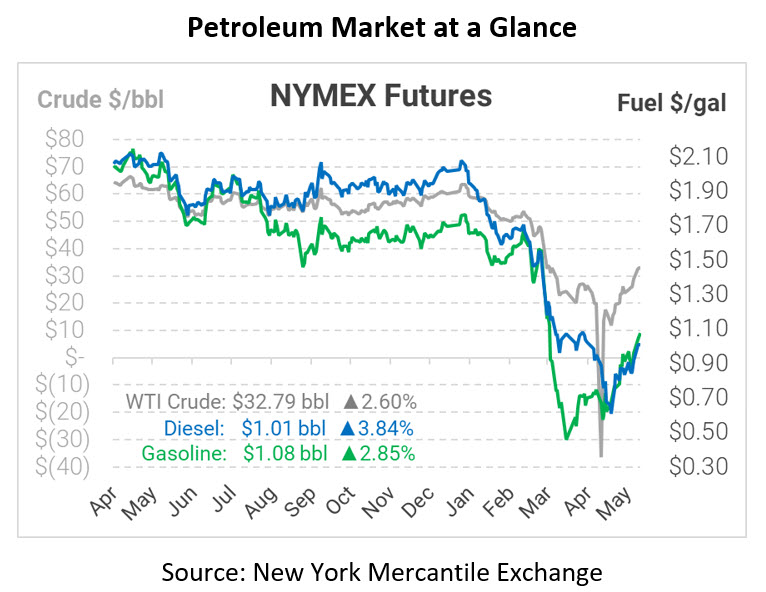

Crude prices are up this morning. WTI Crude is trading at $32.79, a gain of 83 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.0110, a gain of 3.7 cents. Gasoline is trading at $1.0750, a gain of 3.0 cents.

This article is part of Daily Market News & Insights

Tagged: airlines, API, coronavirus, demand, Draw

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.