Inventory Data Shows Demand Rising and Cuts Working

Yesterday, crude prices finished the day at 10-week highs after seeing some downward pressure when the EIA reported inventory numbers. While crude had a surprise draw, products both built more than expected. The bulls won out as the crude market closed with strength.

Markets are seeing an uptick in demand across all products as the US and other countries continue to relax restrictions coming out of quarantine. Traffic and retail data show that people are driving more, and traders are considering the surprise build for gasoline reported by the EIA yesterday as a temporary blip as products continue trading higher this morning.

The record 9.7 MMbpd OPEC+ production cuts that started on May 1, along with additional reductions beyond OPEC+ commitment made by Saudi Arabia, Kuwait, and UAE, are beginning to make an impact on crude markets. So far, in May, OPEC+ has cut oil exports by about 6 MMbpd, according to companies that track the flows, suggesting a strong start in complying with the deal. OPEC is pleased with the market response so far.

The EIA reported a surprise decrease for crude of 5.0 MMbbls, versus an expected increase of 1.2 MMbbls. At Cushing, the EIA reported that stocks fell by 5.6 MMbbls. US crude oil inventories are about 10% above the five-year average for this time of year. Distillates reported a larger-than-expected build and are trending about 19% above the five-year average. Gasoline reported a surprise surge in stocks and is about 10% above the five-year average.

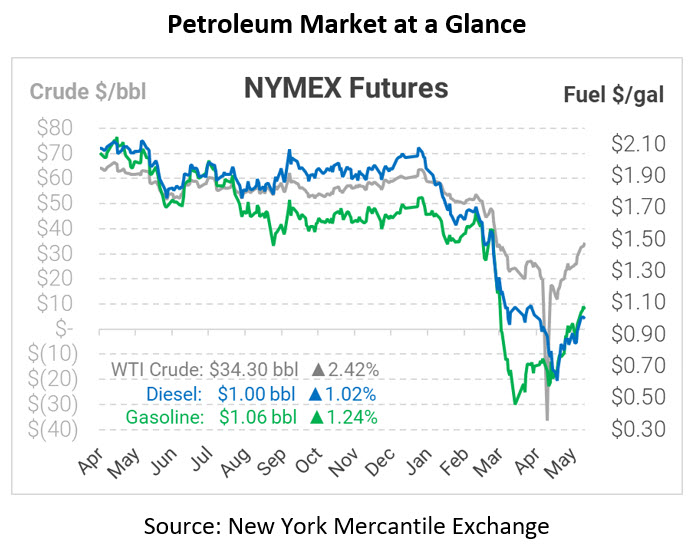

WTI Crude is trading higher this morning at $34.30, a gain of 81 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.0007, a gain of 1.0 cent. Gasoline is trading at $1.0567, an increase of 1.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.