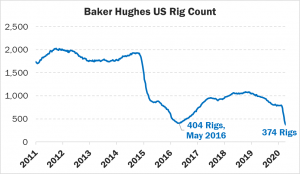

US Rig Count Hits Record Low

Oil prices are moving quietly higher after posting the second consecutive weekly gain on Friday. This morning, Saudi Arabia announced plans to unilaterally cut production by an additional 1 MMbpd beyond their committed cuts, which is giving markets some strength. The additional cuts will bring Saudi Arabia’s output to just 7.5 MMbpd, a huge cut from last month’s 11-12 MMbpd. Other countries are also releasing data showing substantial cuts, including Canada, where production is down 13% (644 kbpd) from February levels.

On Friday, Baker Hughes data revealed that US rig counts have officially fallen to the lowest point since data collection began in 1975. Rig counts are a leading indicator of future production – fewer rigs mean fewer new wells being tapped, which will show up in production data over the coming months.

With just 374 rigs deployed across the US, it’s clear that US producers are suffering amidst the coronavirus-induced price collapse. During the 2015-16 OPEC price war, rig counts fell as low as 404 rigs. On the other hand, rigs are now roughly 30% more productive than they were in 2016 thanks to technology improvements, so even a record-low rig count can sustain more production than in the past.

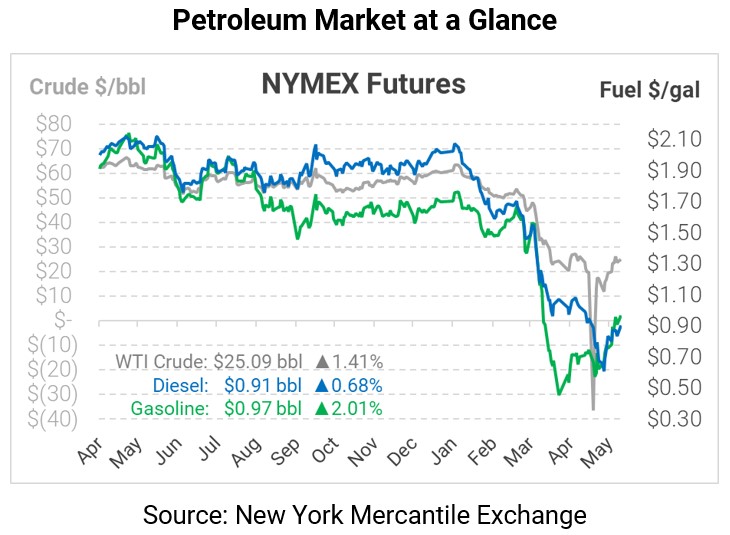

Oil prices are posting lightly higher this morning. WTI crude oil is trading at $25.09, up 35 cents from Friday’s close.

Fuel prices are also trading up, with gasoline leading the market in gains. Gasoline prices are trading at $.9713, up 1.9 cents (+2%) from Friday’s closing level. Diesel prices are $1.9054, up just 0.6 cents (+0.7%).

This article is part of Crude

Tagged: Baker Hughes, Canada, OPEC price war, Saudi Arabia, US rig counts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.