Kuwait and UAE Make Additional Cuts

Yesterday, WTI crude started the morning with a rally on news of additional cuts from Saudi Arabia. As the day progressed a choppy sell-off ensued as fears of a second wave of coronavirus infections began to circulate among traders. Crude markets are up in early trading this morning as signs of a recovery in demand appear evident. Fuel demand is beginning to increase in the US, India, and China as the countries continue to come out of quarantine and businesses and personal travel come back to more normal levels.

The Saudi supply cuts of an additional 1 MMbpd was a primary reason for price moves early yesterday. The additional cut will take Saudi Arabia’s production level to 7.5 MMbpd for next month, the lowest level since 2002. Kuwait announced it will trim its production by a further 80,000 bpd, on top of their OPEC+ commitments. The UAE plans to cut its production by an extra 100,000 bpd in June, on top of its OPEC+ commitments, to support Saudi Arabia’s efforts to balance the market.

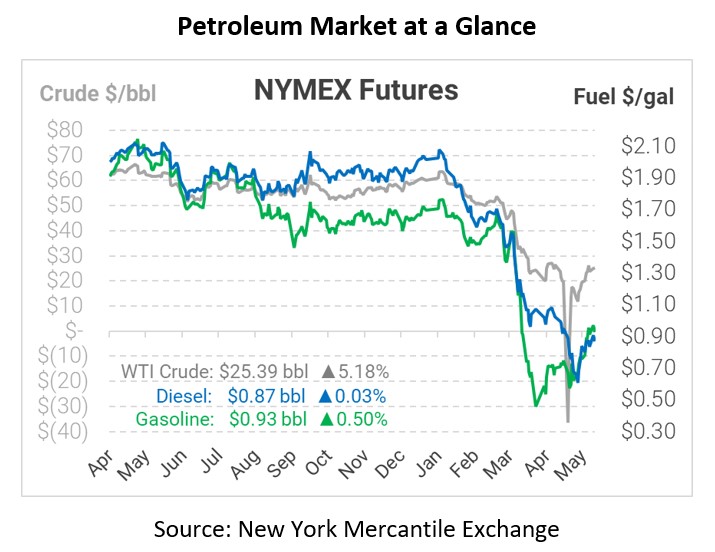

In early trading today, crude prices are up. Crude is currently trading at $25.39, a gain of $1.25.

Fuel prices are flat this morning. Diesel is trading at $0.8690, a fractional gain. Gasoline is trading at $0.9288, a gain of 0.5 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.