Week in Review – May 8, 2020

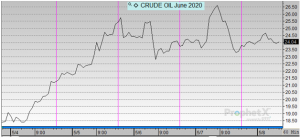

The crude market was up for the week, extending last week’s gains. Still, a “rally” from $16/bbl a couple of weeks ago to $23/bbl today is hardly a sign of a return to normalcy. Markets remain heavily suppressed, with global oil demand still 17-20 million barrels per day below peak levels.

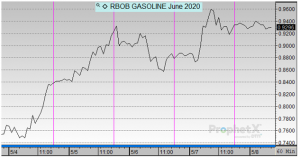

The major news moving markets this week includes an uptick in demand and a possible bottom in prices reported by the EIA. Leading the charge higher was gasoline demand, and jet fuel seems to have bottomed in early April as well. Investors are feeling a sense of optimism as the restrictions on businesses and personal travel continue easing and states and cities in the US carefully step towards reopening. Europe and China are returning to work.

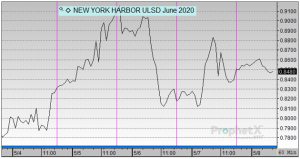

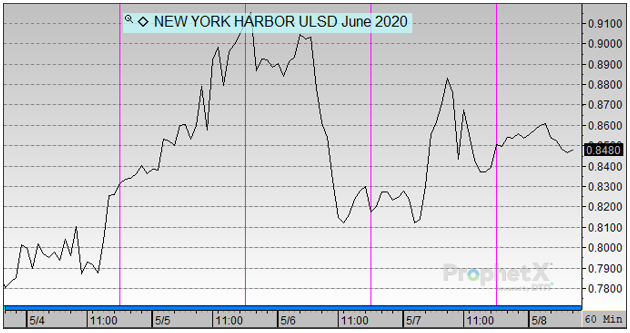

By mid-week, EIA inventory news pumped the brakes on the five-day rally. Larger-than expected builds in crude and diesel slowed the markets, even as gasoline experienced a draw in stocks. Markets recovered to close the week higher as optimism returned, though far below the mid-week highs.

Prices in Review

WTI Crude opened the week at $19.11. It trended upward until mid-week when bearish inventory news halted the five-day rally. Crude opened Friday at $23.35, a gain of $4.24 (22.2%).

Diesel opened the week at $0.7943. It followed an upward track until mid-week when it fell due to a much larger-than-expected build. Diesel opened Friday at $0.8364, a gain of 4.2 cents (5.3%).

Gasoline opened the week at $0.7622. It generally followed crude throughout the week. Gasoline opened Friday at $0.9256, a gain of 16.3 cents (21.4%).

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, diesel, gasoline, Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.