Oil Demand May Exceed Supply in May

A rush of enthusiasm saw crude prices rocket well over $26/bbl, but the rally was short-lived, and the market closed slightly in the red. This morning, most products are posting in the black, though gasoline is lagging the market. Goldman Sachs recently forecast that demand could exceed supply by the end of May, thanks mainly to world-wide production cuts. OPEC has contributed the lion share of cuts, but market forces have caused other shut-ins, including 1.2 MMbpd contractions in US output.

Goldman Sachs is also closely tracking various industries as it relates to economic reopening. As many states discuss reopening, the industry trends clear suggest that businesses benefitting from Stay-at-Home orders are still outperforming, while “Back-to-Business” industries remain contracted. This will be a useful index to monitor as a leading indicator of fuel demand.

As markets slowly narrow the “supercontango” future market spreads, where near-term prices are low but long-term prices are high, companies are taking advantage of the situation by stashing away as much physical inventory as possible. Few are better positioned to take advantage of the situation than Hilco, the company that won the bankrupt Philadelphia Energy Solutions refinery at auction. Hilco will take ownership of the refinery on May 21, including its 1 million barrels of storage. With January 2021 fuel prices trading 15-20 cents above current fuel prices, traders are eager to take advantage of the large storage hub, according to OPIS reports.

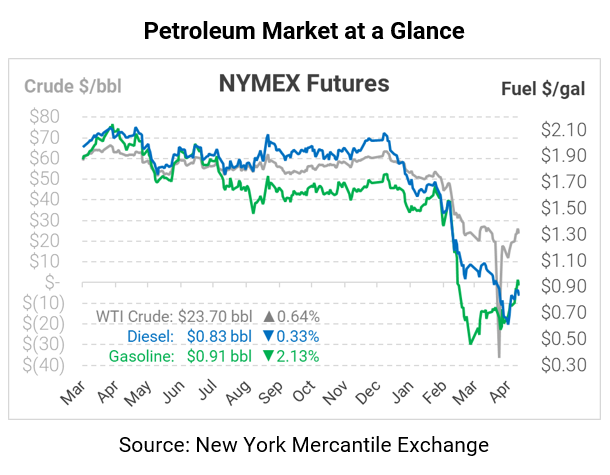

Today, market performance is mixed across different products. Crude oil prices are slightly higher, trading at $23.70 after gaining 15 cents.

Fuel prices, on the other hand, are moving lower, with gasoline leading the way. Gasoline prices are trading at $0.9116, down 2 cents from Thursday’s closing price. Diesel prices are trading at $0.8343, down just 0.3 cents for the day.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.