Week in Review – April 24, 2020

The last week of crude oil prices may go down in history as the most unique week, ever. Besides setting the largest one-day price drop in history (both by percent and by dollars), crude oil futures showed that $0/bbl is not the lower limit for oil markets. Whether this week’s negative oil prices become an anomaly or a recurring pattern is yet to be seen. Some have already begun speculating that similar antics could occur when the June 2020 WTI contract expires.

Markets continued with wide gyrations throughout the week. Although the EIA reported more builds for petroleum product inventories, gasoline’s meager 1 MMbbl gain presented a glimmer of hope that markets may be stabilizing. Refiners have cut back on production, pushing the market imbalances further upstream to the producers, where financial struggles will likely cause production shut-ins. While gasoline gains have slowed, diesel inventories posted a large 7 MMbbl build, causing prices to slide. While the spread between diesel and gasoline has gone as high as 60 cents in late March, the two products today are trading less than a dime apart.

Mid-week, traders reflexively pushed oil prices higher on escalating tensions between the US and Iran. Trump tweeted that the US Navy should “shoot down and destroy” any Iranian vessels harassing them at sea. Of course, with Iran’s oil production already decimated, even all-out war likely would not change the fundamental imbalance of crude oil today. Although prices got a boost from the news, the effects should not last long.

With some states planning to reopen their economy this week and next, markets will be looking closely at demand levels. Some states like Tennessee and Georgia are opening several businesses this week in an attempt to jumpstart sinking economic conditions. But consumers don’t have to leave the house. The two metrics to watch are fuel demand and new COVID-19 cases, which will tell you how many people are leaving the house and whether those states will need to revert to strict social distancing.

Prices in Review

Crude prices experienced the most severe volatility in the product’s history this week. Beginning the week at $17.73, markets opened at $16.78, a 95 cent (5.4%) decline. That benign change masks a massive disruption on Monday, with prices sinking to -$36/bbl. Prices on Tuesday rose to $10/bbl, then on Wednesday closed nearly 40% higher at $13.78.

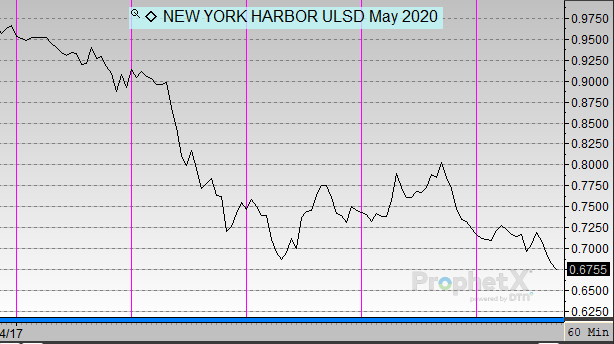

Unlike crude, which crashed early in the week and recovered, diesel prices have steadily fallen for most of the week. Monday was a relatively quiet day, but prices moved much lower following news of a large inventory build. Diesel opened the week at $.9589, falling through the week to open this morning at $.7223. At -24.6%, diesel experienced some of the heaviest losses this week.

Gasoline stemmed some of its losses this week, bouncing off a low of 48 cents to trade as high as 74 cents yesterday. Gasoline opened the week at $.7121 and opened this morning at $.6337, a loss of 7.8 cents (-11%).

This article is part of Daily Market News & Insights

Tagged: COVID-19, eia, Iran, Negative Crude Prices, Reopen, Volatility

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.