Trump Escalates Tensions with Iran

Yesterday, crude prices rallied in the afternoon to close the day higher. This rally came about even in the light of bearish inventory news coming from the EIA with the 13th straight week of weekly crude builds. Prices got a jolt from increased US-Iran tensions escalated by a tweet from Trump. In early trading this morning, crude is continuing its recovery.

In a tweet yesterday, President Trump said that he has ordered the U.S. Navy to “Shoot Down and Destroy” Iranian gunboats if they harass U.S. ships. The tweet follows recent incidents in the Strait of Hormuz off the Iranian coast. On April 2nd a US flagged ship was harassed by heavily armed Iranian patrol boats. That same week, Iran deployed anti-ship missiles on Qeshm Island in the strait. On April 14th, a Hong Kong flagged tanker was seized and then later released in the same waters.

Although somewhat muted because of the recent pandemic, the Strait of Hormuz continues to play an important role in crude markets as it is the number one shipping lane and choke point for crude oil in the world. About 20% of the global supply of oil flows through this strait each day. Rising tensions in the area are often reflected in rising global oil prices.

This week’s EIA report marks the 13th straight weekly climb in oil stocks. The EIA reported a build in line with expectations for crude of 15.0 MMbbls, versus an expected build of 15.2 MMbbls. At Cushing, the EIA reported a 4.8 MMbbls build. Distillates reported a larger-than-expected build and are about 1% below the five year average for this time of year. Gasoline reported a smaller-than-expected build. Gasoline inventories are at record highs but the builds are finally slowing.

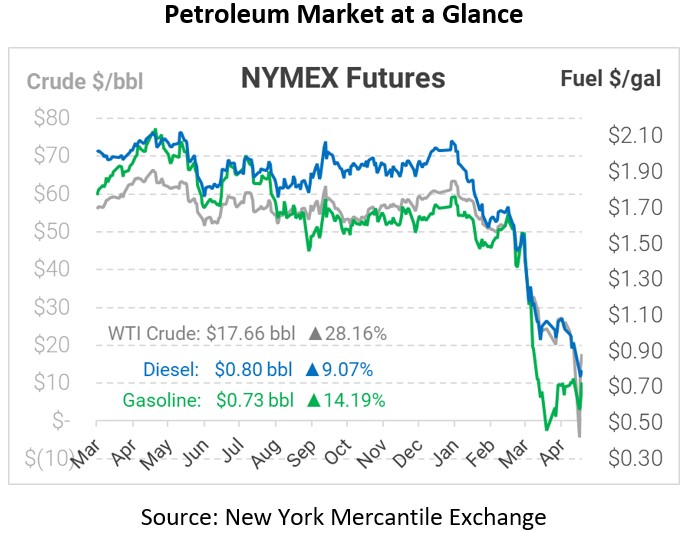

WTI Crude is trading higher this morning at $17.66, a gain of $3.88..

Fuel is up in early trading this morning. Diesel is trading at $0.7974, a gain of 6.6 cents. Gasoline is trading at $0.7290, a gain of 9.1 cents.

This article is part of Crude

Tagged: eia, Iran, rally, Strait of Hormuz, Trump

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.