A Closer Look at the Coronavirus

Pandemic threats are keeping markets on high alert this morning, and prices are plummeting out of fear that demand may grind to a standstill in China. With concerns escalating, we’ll focus today on review what a coronavirus is and why it’s impacting oil markets:

What Is a Coronavirus?

The coronavirus is actually a family of viruses, most of which are not considered dangerous. However, some can be particularly lethal, as was the SARS outbreak in 2003 which killed 774 people, or the MERS outbreak in 2012 which killed 858. Most coronaviruses exhibit symptoms similar to a common cold. The latest coronavirus is classified as 2019 novel coronavirus (2019-nCoV), discovered in early 2020.

What Has the Effect Been?

The disease has already infected around 3,000 individuals in China and abroad, including now 5 instances within the United States in California, Washington, Arizona, and Illinois. Over 50 Chinese individuals have died from infection, though so far no fatalities have been reported outside China. China has shut down Wuhan, the origin point for the pathogen, effectively shutting in 11 million people.

Effect on Oil

The disease comes on Chinese Lunar New Year – a time when hundreds of millions of Chinese citizens travel to see family and celebrate. Think of it like Thanksgiving, but with 4x the population size celebrating. China has been shutting cities and discouraging travel, causing a severe drop in fuel demand and economic spending. Goldman Sachs estimates the oil demand effect will be 260 kbpd. Unlike supply outages, demand drops are not backfilled by other fuel users, meaning the downturn will affect oil prices as long as the disease risk continues.

Equity markets have also faced pressure, particularly for companies with exposure to the Chinese market. NBC reported that the SARS outbreak in 2003 cost global markets $40 billion in lost demand and medical costs. China has already allocated $9 billion to fight against the virus.

Other Market Trends

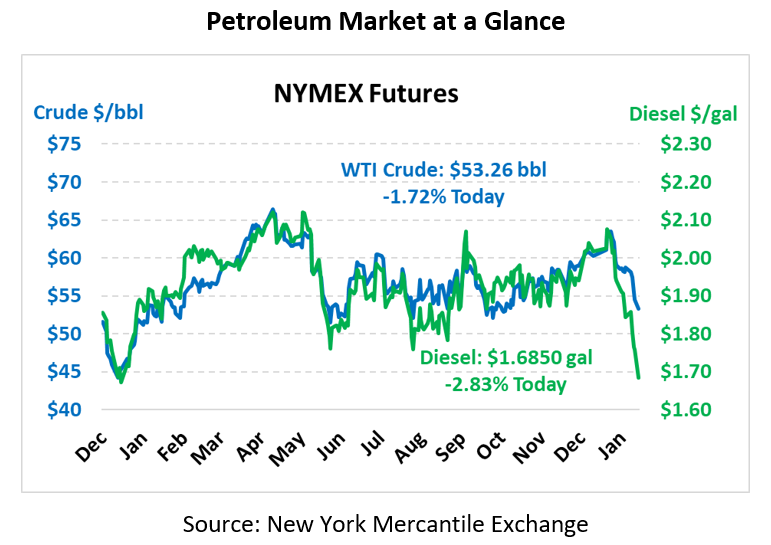

Oil markets were down sharply at opening call this morning, though losses have moderated a bit since then. Crude oil is currently trading at $53.26, down 93 cents from Friday’s closing price.

Fuel prices are falling lower as well. Diesel prices are currently trading at $1.6850, down 4.9 cents from last week’s close. Gasoline prices are $1.4712, down 4.4 cents.

Last week, we reported on 3:2:1 crack spreads falling to a multi-month low point of $12.50. Today, those spreads have fallen even lower to $11.50. Since crack spreads rarely fall significantly below $11.20, expect spreads to bottom out soon and begin rising once again, giving diesel prices a lift relative to crude oil.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.