Back to Fuel Market Fundamentals

Taking a step back from the blow-by-blow of the market, two recent trends are pointing towards very weak diesel markets, though with some hope for a rebound.

1. Diesel Flips to Contango

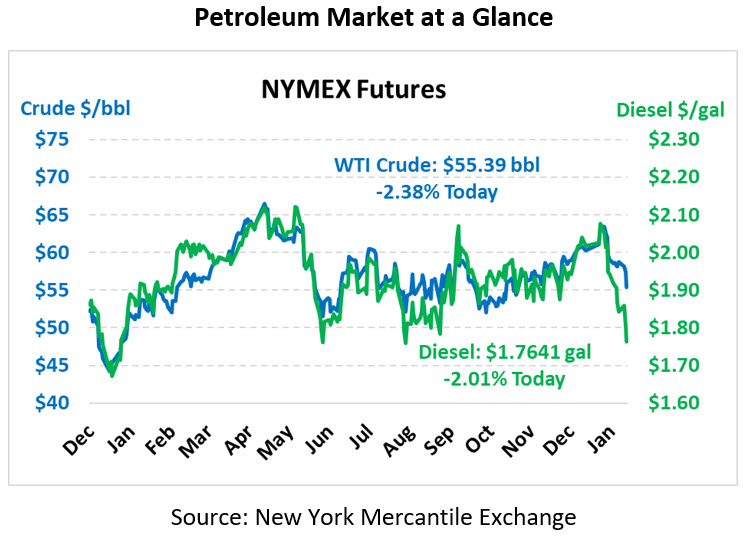

Futures markets are very important indicators of current supply and demand trends. Crude oil markets are still backwardated, meaning future prices are lower than today, but diesel has now flipped to a contango structure. Contrary to appearance, an upward sloping forward curve suggests lower prices in the future, not higher.

At the time of writing, diesel prices in February 2020 are trading at $1.764, while diesel prices in January 2021 are closer to $1.79. This contango structure tells suppliers to put supplies into inventories, rather than selling them now, so they can earn three cents more in the future. Inventories begin rising, prices turn lower, and eventually refiners get the message to stop producing so much excess fuel.

Diesel prices have fallen roughly 15 cents in just over a week, following last week’s hefty diesel inventory build. If this trend continues in today’s EIA report, expect to see the contango structure continue as diesel prices fall.

2. Crack Spreads Fall

Unsurprisingly given the rapid decline in diesel prices, the 3:2:1 crack spread, which represents a refiner’s profit from converting 3 barrels of crude into roughly 2 barrels of gasoline and 1 barrel of diesel, has been trending lower to begin the new year.

Crack spreads are an important supply and demand indicator, telling refiners to start refining more when spreads go low and to stop refining so much when spreads are high. Yesterday’s closing spread of $12.69 is the lowest spread since September, when spreads briefly leapt higher. Back in February when spreads fell as low as $11, they quickly spiked due to summer demand back up to the high end of the range.

Spreads are moving close to the normal seasonal low of roughly $11/bbl. Spreads may continue falling to that point, or they may rebound sooner, but any further decreases are unlikely. Spreads have not dipped below $10/bbl since 2016, when fuel prices were hardly $1/gal. While total fuel prices may continue falling if crude prices tumble, it seems diesel’s decline relative to crude is running out of steam.

Market Trends

Oil markets are reacting this morning to more expected builds in petroleum inventories, following the API’s report of across-the-board builds. In particular, the market had expected a crude draw this week, but the API shows a build for crude stocks. Markets will be paying close attention to the EIA’s inventory data posted at 10:30 AM today, a day late due to Martin Luther King Day earlier this week.

Crude prices are continuing their rapid descent this morning, plummeting back down towards the bottom of the $50-$60 range in which they have traded for the past year. Crude is currently trading at $55.39, down $1.35 (2.4%) from yesterday’s close.

Fuel prices are also falling rapidly. Diesel prices are trading at $1.7641, down 3.6 cents (-2.0%) from Wednesday’s closing price. Gasoline prices are trading at $1.5532, down 2.6 cents (-1.7%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.