Canadian Oil Can’t Catch a Break

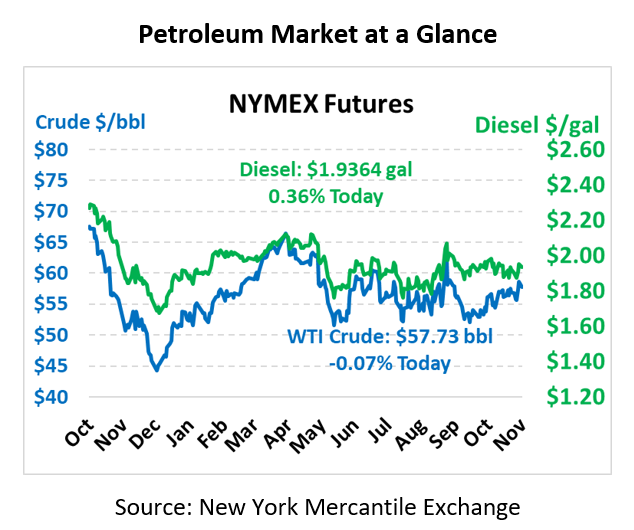

Characteristic of a holiday week, oil markets are seeing weakness on light volume trading. Early morning losses are subsiding, leading prices to trade in line with Friday’s close. This morning, crude oil is trading at $57.73, hardly changed from Friday.

Fuel prices are mixed this morning, with diesel finding some room for upward gains. Diesel prices are currently trading at $1.9364, up 0.7 cents from Friday’s close. Gasoline prices are trading at $1.6630, down 1.1 cents.

Canada’s oil sector has been going through a rough patch lately. With the Keystone pipeline from Canada into the US running at reduced pressure due to the severe leak a few weeks ago, imports have slowed. Now, workers are striking at a Canadian rail facility, which could hamper crude-by-rail shipments as well. Canadian National Railway hauls roughly half of Canada’s crude-by-rail exports, and on Tuesday last week, workers walked off the job. Experts could begin to see an impact as early as this week.

Last week’s inventory report revealed a drop in Cushing, OK inventories of 1.2 million barrels even as total US crude storage rose. Cushing inventories are symbolically important for crude oil trades, since all WTI crude oil transactions are based on physical deliveries to Cushing. If the current rail strike persists, we could see yet another draw in upcoming inventory reports. Last week’s EIA report spurred a rally for oil markets; another Cushing draw could re-energize markets and cause another push for higher prices.

On the trade front, the US and China continue oscillating in their statements regarding a trade deal. US national security advisor said a deal may occur before the end of the year, while Trump hinted he may not want a deal this finalized this year. Chinese President Xi Jinping commented that China would retaliate if the US continues its tariff approach.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.