Canadian Railway Strike May Impact Gulf Coast

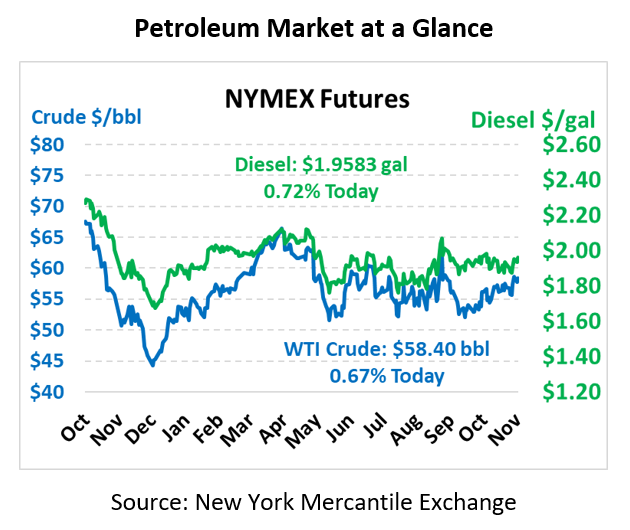

Crude is up on recent positive trade sentiment. Crude is currently trading at $55.40, a gain of 39 cents.

Fuel prices are up in line with crude. Diesel is trading at $1.9583, a gain of 1.4 cents. Gasoline is trading at $1.6887, a gain of 1.4 cents.

A strike at Canada’s largest rail carrier entered its seventh day Monday, causing concerns that prolonged negotiations could interrupt flows to US Gulf Coast refiners that have grown dependent on train shipments from Western Canada after imports of heavy crude from Venezuela collapsed. Canadian National Railway carries more than 170 kbpd of crude from Alberta, according to the province’s energy ministry; the rail strike’s potential to cause heavy crude differentials on the Gulf Coast was seen the first day of the strike, November 19, when heavy Mars crude spiked $0.80/bbl to a premium of $2.45/b to cash WTI.

Multiple reports stated that China’s Ministry of Commerce said top trade negotiators from the United States and China had a phone conversation Tuesday morning discussing their concerns and agreeing to maintain dialogue on a potential interim trade agreement. The two sides attempt to conclude a preliminary “phase one” deal amid rising tensions between the two countries regarding protests in Hong Kong. China stated it had asked the US ambassador on Monday to protest the passage in the US Congress of the Hong Kong Human Rights and Democracy Act. The markets have been closely watching the back and forth between Beijing and Washington and hope for a trade deal to materialize soon.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.