Saudi Aramco Officially Going Public

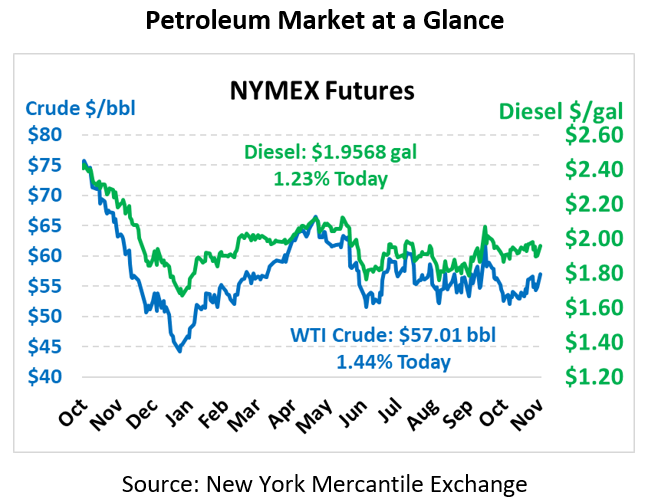

Oil prices roared higher on Friday thanks to surprisingly strong economic reports in the US and China. Today those gains continue. WTI crude oil is trading at $57.01, a gain of 80 cents (1.4%).

Fuel prices are also zipping higher. Diesel is trading at $1.9568, up 2.4 cents (1.2%) from Friday’s close. Gasoline prices are $1.6707, up 1.5 cents (0.9%).

Saudi Arabia’s national oil company, Saudi Aramco, officially announced plans to go public on Sunday following years of on-again, off-again drama related to its IPO. Having received approval from regulators, Aramco will now begin building a prospectus and courting potential investors. The opening price is yet to be seen – the Saudi government in 2018 sought to list 5% of the company for $100 billion, suggesting a $2 trillion valuation for the entire company.

Saudi Crown Prince Mohammed bin Salman plans to use the IPO funds to diversify Saudi Arabia’s economy, decreasing their dependence on oil. While Saudi Arabia will always prefer higher oil prices, a less oil-dependent country may not feel the same urgency to push for OPEC production cuts, making the event potentially bearish for oil (though that transition could take decades to realize). Short-term, expect Saudi Arabia to be tenacious in pushing prices higher, since higher oil prices equate to a higher company valuation.

In trade news, things are looking positive. Both US and Chinese sources are hinting at progress, and President Trump has remained in contact with Chinese President Xi on the trade deal. Chinese media outlets pointed to a “consensus on principles”, signaling that negotiators have found ways to circumvent (or at least, delay until the next phase) major impasses. Trump went so far as to suggest the deal might be signed in Iowa, an agricultural state hit hard by tariffs.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.