Comfortable with Oil Prices? That’s a Bad Sign

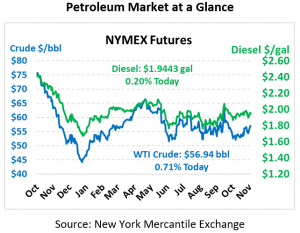

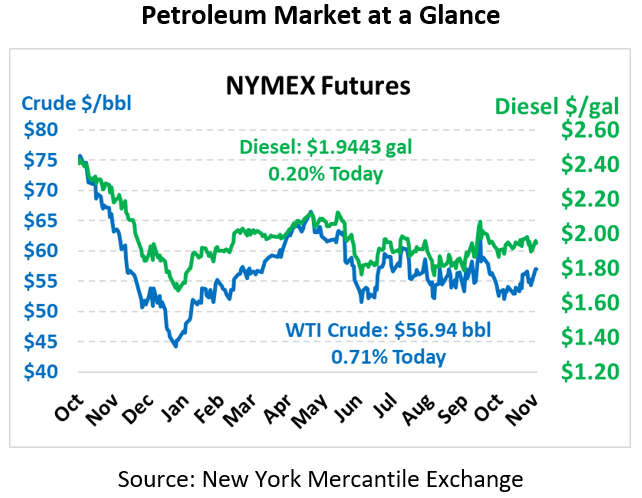

Oil prices are continuing their upward trend this morning after gains weakened yesterday afternoon. Although prices launched nearly a dollar higher at points in the day, crude closed just 30 cents higher at the end of yesterday’s session. Today, crude oil is trading at $56.94, up 40 cents.

Fuel prices also saw moderate gains yesterday, with diesel up 0.7 cents and gasoline up 0.8 cents. This morning, gasoline is leading the charge, up a penny to trade at $1.6734. Falling behind, diesel prices are currently $1.9443, up 0.4 cents.

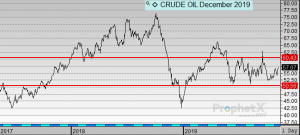

For a bit of context on how today’s higher prices compare to recent prices, the chart below shows WTI crude oil prices over the last few years. The red lines represent a basic zone in which prices have trended throughout 2019. There’s been no sharp break higher or lower, save for a brief period early in 2019. Even Saudi Arabia’s oil attack could not significantly move the markets outside this range. Economic concerns have put a heavy lid on the market, while OPEC cuts have maintained the floor.

With those two factors at play, it’s no wonder that nearly every market headline for months has centered on economic factors and OPEC cuts. Unlike the political news cycle, which has a new breaking headline every few hours it seems, oil markets have been steadier. Of course, we’re only one surprise event away from a huge break higher or lower. A surge in US production, a tumbling economy, IMO 2020 fears, a surprise Middle Eat skirmish – any number of events could radically alter the current market environment. Point being, it’s been a comfortable range for many fuel buyers, but you should never get too comfortable with volatile markets such as oil.

To that end, trade talks are beginning to show some meaningful signs of progress, so much so that China is reportedly asking that 15% tariffs on $112 billion of Chinese goods be lifted before or as part of Phase 1 of the trade deal. That’s a huge ask – one that in previous negotiations rounds might have even caused talks to shut down completely – so how the US responds this go-round will be a big clue on how significant Phase 1 of the trade deal will be.

The Keystone pipeline leak that occurred last week continues to be a challenge for the industry, and as of yesterday the source of the leak had not been identified. Assuming the leak is found soon and repairs made quickly, the leak could be a non-event for oil markets. If, however, the outage extends as it did in late 2017, it could cause oil reserves in Cushing to fall rapidly, pushing WTI crude prices higher relative to international Brent prices. Already, Canadian crude prices have fallen to $20/bbl below WTI, a large enough spread to incentivize crude-by-rail shipments out of the country if needed.

This article is part of Crude

Tagged: 2019, China, economic factors, IMO 2020, Keystone pipeline, Middle East, oil prices, opec, phase 1, Saudi Arabia, tariffs, trade talks, US, US production

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.