Rick Perry Resigns from DOE

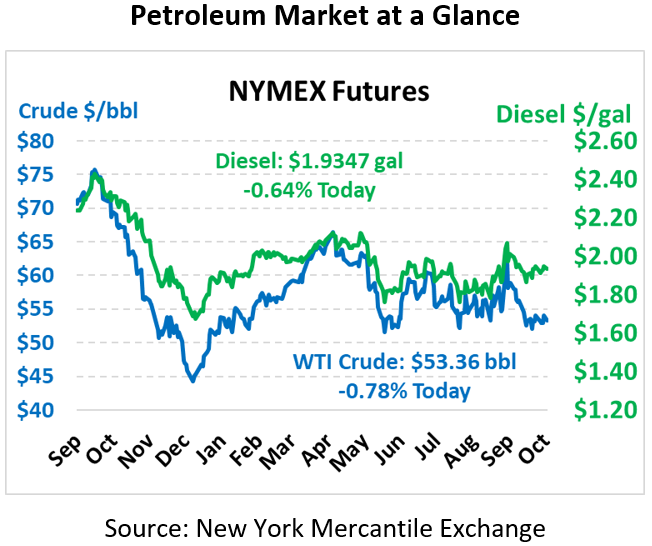

Oil prices are reversing last week’s gains amid further deterioration in US trade relations, with both China and the EU. Crude oil is currently trading at $53.36, down 42 cents.

Fuel is also down this morning. Diesel is trading at $1.9347, a loss of 1.2 cents. Gasoline is also lower, trading at $1.6059, down 1.7 cents.

After many rumors circulating, President Trump announced last Thursday that Rick Perry was resigning from his post of Secretary of Energy due to his involvement in the Ukraine scandal. Perry reportedly led a delegation to Ukraine earlier in the year, entangling him in impeachment probing.

For the past few years, Perry has remained out of the political spotlight as Energy Secretary despite an impressive set of accomplishments. Although the DOE has little direct impact on oil production, Perry did impact energy more broadly by championing continued research in battery storage and solar energy while establishing a new cybersecurity office to ensure energy infrastructure protection. Perry also pushed for increased exports of fossil fuels to Ukraine and other European countries reliant on Russian natural gas. Perry will be succeeded by Deputy Energy Secretary Dan Brouilette, a career bureaucrat who has assisted Perry in championing several reforms.

Despite progress in negotiations between the US and China, both sides have a long way to go even before Phase 1 of negotiations can be completed. China is now pursuing $2.4 billion in tariffs against the US for World Trade Organization (WTO) violations that occurred during the Obama administration. Although the new tariffs are lawful under WTO rules, they may sour negotiations by sending the wrong signal. On the more positive side, Trump’s top economic advisor Larry Kudlow hinted that the next round of tariffs, scheduled to hit in December, could be eliminated if trade discussions go well – which would be the first sign of tangible progress from negotiations in quite some time.

In other trade news, Trump is ramping up pressure on the EU. On Friday new US tariffs targeting $7.5 billion in goods hit European airplanes, wines, and cheese. The tariffs are a legal response permitted by the WTO in response to illegal subsidies to European airline Airbus. Of course, the US has also been found guilty of illegally subsidizing Boeing, which makes the situation more complex. For goods such as wine and cheese, products can be shipped early to avoid the tariffs, and markets saw rapid shipments over the last few weeks. But airplanes cannot be shipped early, making the tariffs more challenging for airline companies. As a result, the addition of airlines to the tariff package has added a stronger economic impact than if tariffs had only targeted more symbolic goods.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.