Economic Sentiment Improves, Oil Rises

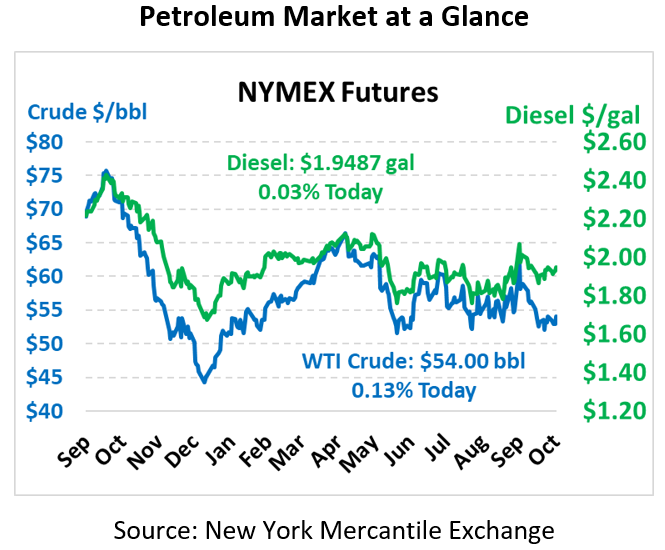

Oil is up slightly this morning on bullish trade news. WTI Crude is trading at $54.00, a gain of 7 cents from yesterday’s close.

Fuel is flat in morning trading. Diesel is trading at $1.9487, up fractionally. Gasoline is trading at $1.6276, up half a penny.

Positive sentiment from the US and China helped to alleviate concerns over economic growth, at least for a brief period. China’s refinery activity reportedly rose, signaling higher crude demand for international suppliers. On the trade front, Treasury Secretary Steven Mnuchin hinted that the first phase of a trade deal could be signed next month – a positive indicator of progress. Whether Phase 1 is a symbolic gesture or a substantive change is yet to be seen.

While on the international topic, Brexit seems to be getting closer to a resolution. EU leaders have now unanimously endorsed a deal with Brexit, leaving it to British Prime Minister Boris Johnson to push the deal through Parliament over the next few days.

The EIA’s report yesterday generally tracked the API’s data, including a hefty crude oil build along with diesel draws. Surprisingly, the market took a turn higher yesterday following the EIA’s numbers, on the heels of continued diesel inventory draws.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.