Week in Review – October 18, 2019

The Crude Market was down for the week, however, we are seeing some gains in morning trading on Friday. The week started with the hopes of a partial trade deal between the U.S. and China being delayed which brought prices lower. The markets remained flat through the week as they waited on inventory numbers that were delayed by a day due to the Monday Columbus Day holiday.

The EIA report on Thursday confirmed a large crude build reported by the API which was offset by draws in products. Also, on Thursday, bullish news of a possible Brexit deal drove the dollar down which helped to support oil prices. Markets are continuing gains from Thursday in early trading on Friday.

Prices in Review

WTI Crude opened the week at $54.90. It fell early and went up and down through the week but closed the week on an upward trajectory. Crude opened Friday at $54.09, a loss of 81 cents (-1.5%).

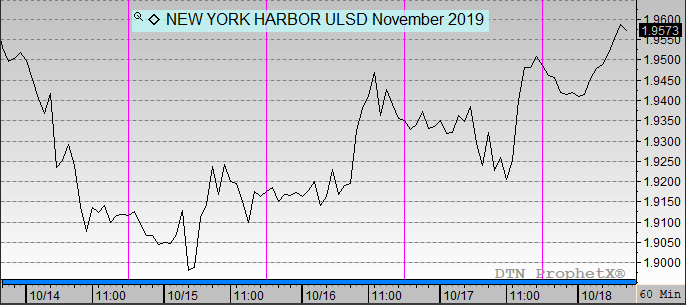

Gasoline opened the week at $1.6439. It generally followed crude through the week. Gasoline opened Friday at $1.6220, a loss of 2.2 cents (-1.3%).

Gasoline opened the week at $1.6439. It generally followed crude through the week. Gasoline opened Friday at $1.6220, a loss of 2.2 cents (-1.3%).

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.