Saudis Ceasefire with Yemen, Winter Approaches Rockies

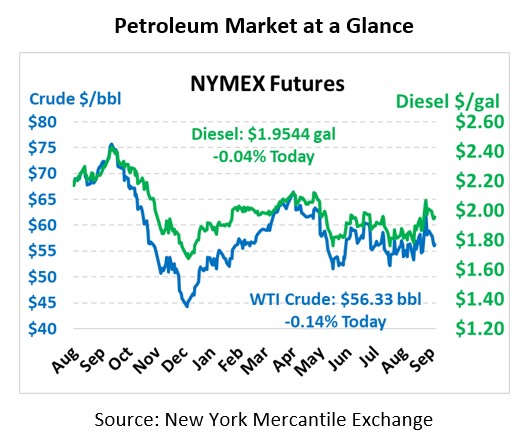

Markets are flat this morning following a partial ceasefire between Saudi Arabia and Yemen, a huge step following the attacks just two weeks ago. Crude markets continue a week-long downward trek. WTI crude is currently trading at $56.33, down 8 cents from Thursday’s close.

Fuel prices are flat to close the week. Diesel is trading at $1.9544, a fractional loss. Gasoline is trading at $1.6600, also fractionally lower.

Saudi Arabia agreed to a ceasefire with Yemen following an unexpected request by Yemeni Houthi rebels that came just days after they claimed credit for the attack. The ceasefire follows a Saudi attack on Yemen that killed 17 civilians and reportedly used US-made weapons. The UN has described Yemen as the world’s worst humanitarian crisis, and the country hopes that a cease-fire will allow re-building of infrastructure and growth. At the same time, the US has increased its military presence within Saudi Arabia to help bolster defenses in case of another attack.

For oil prices, the decreased tensions help further calm the geopolitical risk at play in the Middle East. While eyes are still focused on Iran, the Saudi-Yemen conflict has been waged for years and put Saudi oil at risk several times. A ceasefire, for however long it lasts, could help moderate the risk premium currently built into oil prices.

Looking domestically, winter weather is already beginning to rear its head in the northern Rocky Mountains. A major snowstorm Is beginning its move through parts of Montana, Idaho, Wyoming and the Dakotas, bringing heavy snow over the weekend in a surprising early-season blast. Winds could rear up as high as 60 mph in some areas, above tropical storm force winds. The storm is expected to impact road conditions, including portions of I-90 and I-15. Click Here for more info on the storm and its impact on logistics.

This article is part of Crude

Tagged: ceasefire, oil prices, Rocky Mountains, Saudi Arabia, snowstorm, Yemen

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.