Week in Review – September 27, 2019

The Crude Market was down for the week. The week started as a continuation of last week with the markets continuing to weigh the outcomes form the attack on Saudi oil infrastructure. Despite international consensus that Iran was behind the attacks, it became clear that direct military action against Iran was unlikely. As the week progressed, it became apparent that Saudi production was coming back on line quickly which drove markets lower.

A bearish inventory report by the EIA mid-week continued to put downward pressure on the markets. A surprise crude build went against expectations of a small draw. At Cushing, API reports were confirmed by the EIA of the first crude build in 12 weeks. This inventory data was significant when considering that the builds occurred while Saudi supply was less than fully operational. It is an indication that the U.S. is somewhat insulated from global supply constraints due to high production in the Permian.

Prices in Review

WTI Crude opened the week at $59.25. It followed a steady downward trend all week. Crude opened Friday at $56.51, a loss of $2.74 (-4.6%).

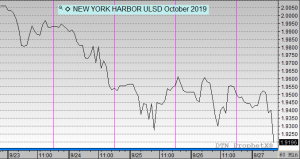

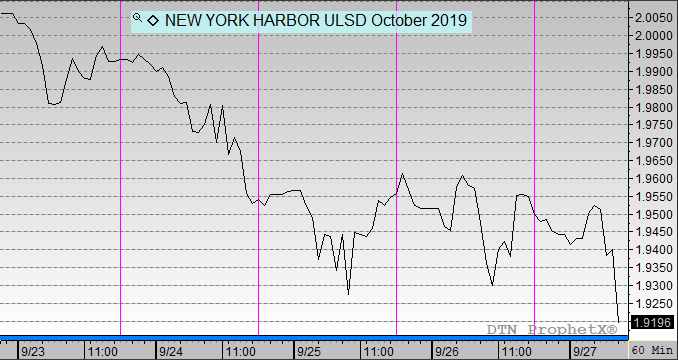

Diesel opened the week at $2.0239. It generally followed crude through the week. Diesel opened Friday at $1.9563, a loss of 6.8 cents (-3.3%).

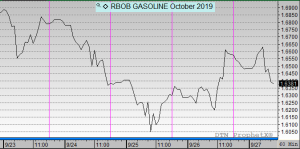

Gasoline opened the week at $1.6946. It followed crude until Thursday when it rebounded somewhat. Gasoline gave back some of its Thursday gains in early trading on Friday. It opened Friday at $1.6575, a loss of 3.7 cents (-2.2%).

This article is part of Crude

Tagged: attacks, high production, prices, Saudi, U.S., Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.