Fed’s Dovish Stance Outweighs Trade War Concerns

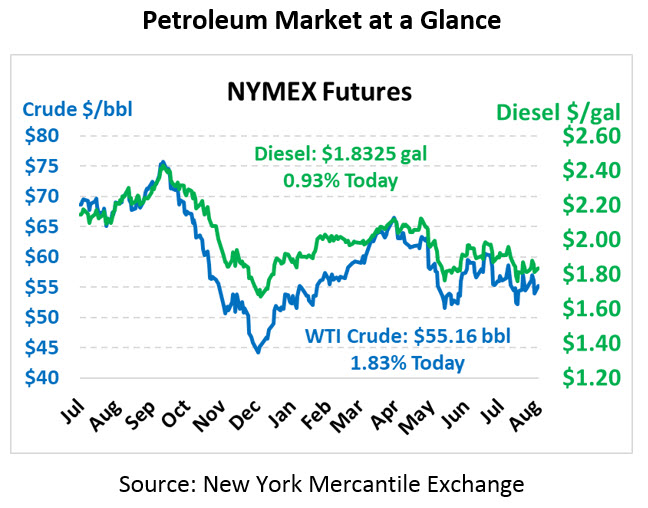

Oil prices are once again tip-toeing higher after ending last week with significant losses. Still, price remain bound within the $50-$60 range in which they’ve held steady since May. Today, prices head back towards the midpoint of that range. WTI crude oil is currently trading at $55.16, up almost a dollar from Friday’s close.

Fuel prices are also on the rise today. Diesel prices are currently $1.8325, up 1.7 cents since Friday. Gasoline prices are $1.6650, up 2.2 cents.

Last weekend we noted that the Federal Reserve and other foreign central bank leaders were heading to Jackson Hole, Wyoming for a financial summit. Fed Chairman Powell indicated that the US economy is in a good spot, but highlighted risks that could jeopardize growth – ultimately leaving room for a rate cut later this year if needed. Some of the upward move this morning is attributable to the dovish stance the Fed is taking – interest rate cuts would stimulate economic growth and help the US economy weather the global slowdown.

The trade war continues to be treated as the largest risk to the US (and global) economy. China on Friday responded to President Trump’s escalation by announcing their own tariffs on US oil, soybeans and automobiles. Trump then reacted by raising current tariffs from 25% to 30%, effective October 1, and raising the impending tariffs from 10% to 15%. Today, Trump claimed he spoke with a Chinese representative offering to resume negotiations; China denies the call occurred while still agreeing that “calm” negotiations (ie, not escalatory threats) should continue. Last week Trump ordered US companies to cease their operations in China, though it’s not clear whether companies are reacting to the order or not.

Two storms are rising in the Atlantic Ocean this week. Invest 98 is currently travelling northeast, traveling away from the US East Coast with no current indications of US landfall. Of more note, Tropical Storm Dorian is growing in the Atlantic and on track to travel over Puerto Rico, potentially strengthening to a hurricane. We’ll report more on Dorian as the storm progresses.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.