US Rig Count Keeps Falling

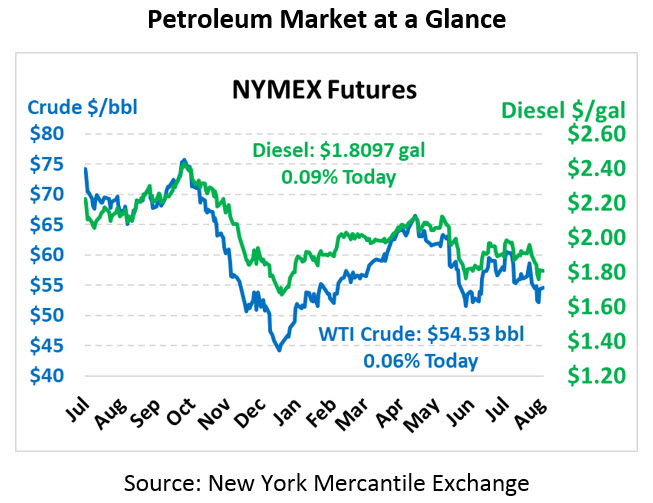

Following a tumultuous week for fuel prices, the weekend was relatively calm. Picking up $2/bbl on Friday, the week ended with light $1/bbl losses relative to the beginning of the week. Today, crude prices are flat after a brief stint higher, currently at $54.33.

Fuel prices are mixed, with diesel staying flat while gasoline prices continue falling. Diesel is currently trading at $1.8097, a mere 0.2 cents higher. Gasoline prices are currently $1.6648, almost a penny below Friday’s close.

With headlines staying calm over the weekend, markets were able to focus more on fundamental market drivers reported on Friday. The Baker Hughes rig count showed North America rigs falling slightly last week, continuing a broader trend of declining US rig counts as prices have turned lower. The rig count is only one data point, however.

As rig counts have fallen, there has not been a correlated decrease in US oil output, as rig counts are merely a leading indicator of future production. Often, rigs are deployed to drill wells that are not actually brought online until a later date. The inventory of these wells, called DUCs (Drilled but UnCompleted), has risen rapidly since 2017 but has recently plateaued since October as oil prices collapsed. The decrease indicates that American producers are focused more heavily on tapping into existing potential rather than drilling new wells. As investors demand cash flow from producers, those producers are being more careful to focus resources on the strongest areas rather than expanding to newer, more complex fields.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.