Saudi Props Up Market

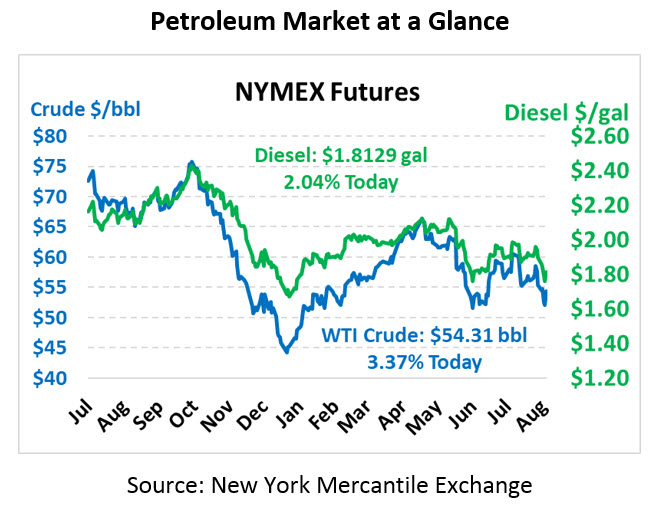

Although prices have dropped precipitously this week to the lowest point since January, late-week action has brought a move higher. Crude prices climbed over a dollar higher yesterday, while fuel put in roughly 2.5 cent gains. This morning, WTI crude is trading at $54.31, up $1.77 (3.4%).

Fuel prices are also continuing to climb higher. Diesel prices are currently trading at $1.8129, taking back 3.6 cents (2.0%) lost earlier this week. Gasoline prices are $1.6779, up 3.2 cents (2.0%).

Saudi Arabia’s announcement that they will balance global market supplies continued to provide support to prices. Today the IEA released their monthly oil report, bringing further reductions in their demand outlook for 2019 and 2020. Demand this year is expected to rise by just 1.1 MMbpd, while Non-OPEC supplies have soared by 1.9 MMbpd – the question, then, is how much longer OPEC can manage keeping oil markets in check.

Also in the Middle East, the US has accused Iran of purposefully distorting GPS signals of ships travelling through the Strait of Hormuz. Shipments through the Strait have so far continued thanks to increased military support from the US, the UK, and others, though insurance premiums have certainly gone up. So far no individual ship abduction has escalated to conflict, but it has certainly raised alarm for nations with this in the area.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.