Week in Review

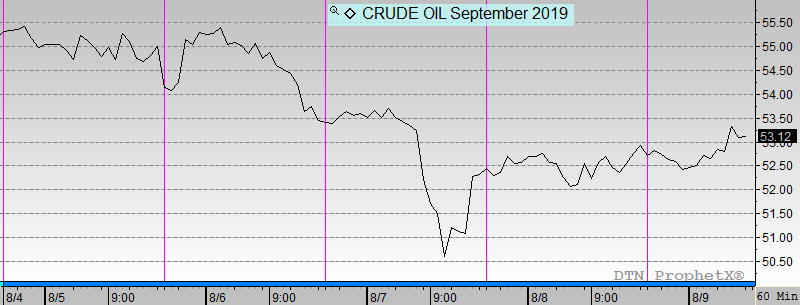

For the week, the Crude Market was down. The week started lower, still reeling from last weeks news of new Chinese tariffs, a slowing global economy, and fear of decreased global oil demand. The statement by the Fed that the rate cut last week may have been an insurance cut and not necessarily indicative of future monetary easing helped bring equities and oil lower last week into this week.

A surprise crude build mid-week helped bring the markets lower, but crude followed equities higher in Thursday’s trading. News that OPEC is considering taking action to support prices has helped oil to rally. The rebound is continuing in early morning trading on Friday, as crude continues to see moderate gains.

Prices in Review

WTI Crude opened the week at $55.38. Prices saw steady losses through mid-week trading, but is recovering somewhat from lows as the week closes. Crude opened Friday at $52.88, a loss of $2.50 (-4.5%).

Diesel opened the week at $1.8752. It followed crude throughout the week. Diesel opened Friday at $1.7846, a loss of 9.1 cents (-4.8%).

Gasoline opened the week at $1.7680. It followed crude closely during the week, but had steeper losses. Gasoline opened Friday at $1.6505, a loss of 11.8 cents (-6.6%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.