Iran Suffers Hyper-Inflation, US Inventories Fall

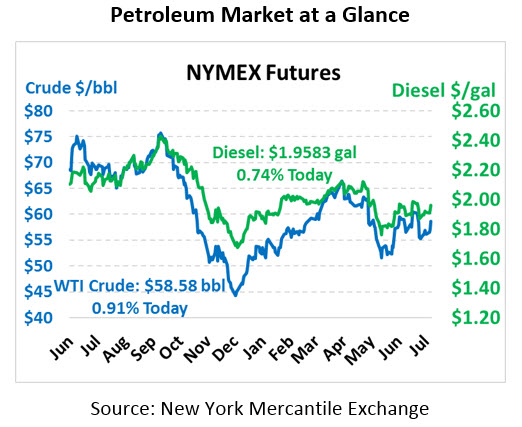

Oil prices rocketed higher last night heading into the close, driven by a bullish oil report from the American Petroleum Institute. WTI crude rose by $1.18 just ahead of the close. This morning, crude is trading at $58.58, up 53 cents from yesterday’s close.

Fuel prices have also received a lift, with both gasoline and diesel passing key thresholds. Diesel is trading at $1.9583, up 1.4 cents. Gasoline prices are up over $1.90 at $1.9029, up 0.6 cents.

The API’s data revealed yet another hefty draw from US crude inventories, with a 6 million barrel draw. While that’s barely more than half the draw seen last week, it continues the trend of steep draws which are quickly moving US inventories back towards the average. Fuel inventories also tracked lower, supporting prices across the board. Now markets await the EIA’s report to confirm whether the API’s data is correct.

In international news, tensions with Iran continue to create complications for global supply chains. BP’s CEO announced the company will avoid sending ships through the Strait of Hormuz. Some countries such as the UK have deployed naval assets to protect ships commuting through the Strait. Sanctions on Iran are putting pressure on their economy. The Iranian government plans to slash four zeros off its national currency, the rial, following nearly 400% inflation over the past 4 years. For context, the current exchange rate with the US dollar would be roughly 120,000 rial to $1. Cut off from the international banking system, the country has no choice but to inflate its currency with government spending to continue growth.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.