Markets show disappointment in Fed position on future cuts

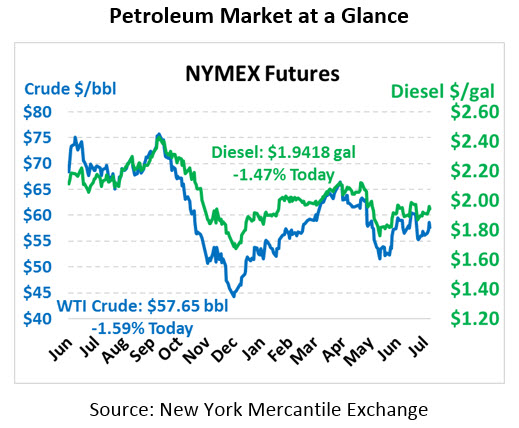

Oil prices are trading lower Thursday morning with WTI Crude trading at $57.65, down 93 cents from yesterday’s close.

Fuel prices are also down with diesel trading at $1.9418, down 2.9 cents. Gasoline prices are also trading lower at $1.8331, down 3 cents.

The Fed cut rates by 25 basis points on Wednesday afternoon, but Fed Chairman Powell indicated that it might not extend interest rate cuts in the near future. Traders took the remarks to mean that more monetary easing later this year was not assured. Equities dropped sharply while crude held on to modest gains yesterday due to crude draws to inventory.

The EIA reported an 8.5MMbbls draw in crude stocks. The draw was larger than API estimates and helped to buoy crude in the face of disappointing news from the Fed and a sharply lower equities market. Both crude and products, however, are trading lower in early trading on Thursday.

In international news, production at Libya’s Sharara oilfield was stopped by a valve being shut by an unknown group. This field produces 300,000 bbls/day. A stoppage of this size would normally affect markets, but Libya’s production has historically been volatile, and the markets tends to treat these shut-ins as temporary.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.