Markets Await TS Berry’s Weekend Landfall

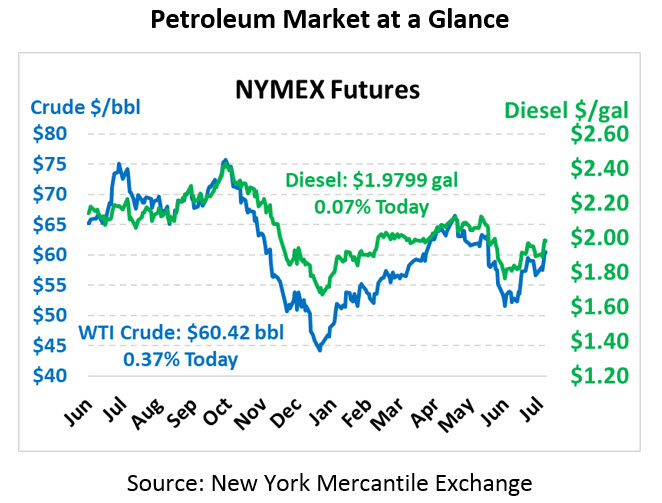

Oil remains steady as we head into the weekend, with markets still resting after Wednesday’s huge gains. Crude oil is trading just slightly higher, at $60.42 after 22 cent gains.

Fuel prices are mixed, with diesel tracking crude while gasoline falls. Diesel is trading at $1.9799, flat with yesterday’s close. Gasoline is trading 1.1 cents low at $1.9786, dropping below diesel prices for the first time since the July 4 holiday.

Markets continue to watch as Tropical Storm Berry approaches the Gulf coastline, and the National Hurricane Center has issued hurricane warnings for the Louisiana coast. Berry has already shut in 1 MMbpd of offshore oil production, though rigs typically reactivate quickly once a storm has passed. So far, only few refineries and terminals have announced plans to shut, though if Berry causes flooding along the Mississippi it could temporarily impact the numerous fuel hubs along its path. The Port of New Orleans has ceased operations, and several ports in Texas are on alert and are closely monitoring the storm. Such sea-borne limitations may impact shipments of fuel to Florida, which is entirely barge-fed, extending the potential supply implications of the storm.

Saudi Arabia this week reiterated plans to keep their production below 10 MMbpd, adding that exports would stay under 7 MMbpd. The country contributes the lion share of OPEC cuts, so continued austerity should help keep markets balanced. At its recent meeting earlier in July, OPEC made clear they planned to continue cuts to accommodate America’s rising production.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.