Week in Review

This week the big 3 monthly oil reports were released, though their impact on the market was moderate at best. The EIA’s Short-Term Energy Outlook upped US production targets to 12.4 MMbpd this year and maintained next year’s 13.3 MMbpd forecast; however, the agency reduced 2019 global oil demand averages by 200 kbpd. Demand reductions in areas such as China, Japan and Europe are expected to offset growing consumption in the US.

OPEC’s Monthly Oil Market Report showed demand rising 1.1 MMbpd next year, relatively slow growth. Their report highlights that rebalancing markets will likely take longer than expected, which could potentially lead the group to deepen their cuts in the months to come. Unlike the EIA and OPEC, the IEA maintained their demand growth prospects at 1.2 MMbpd and 1.4 MMbpd for 2019 and 2020, respectively; however, they predict a general oversupply next year.

While the reports were influential this week, the biggest highlight was the EIA’s weekly oil data, which revealed a hefty crude oil draw. That led prices to peak above $60, remaining steady there for most of the latter half of the week.

Crude oil began the week at $57.77, coming off a holiday weekend that saw light trading activity. Prices remained unchanged on Monday and Tuesday but rocketed higher following the EIA’s report. Prices hovered steadily higher to end the week, with an opening price Friday of $60.46, a weekly gain of $2.69 (4.7%).

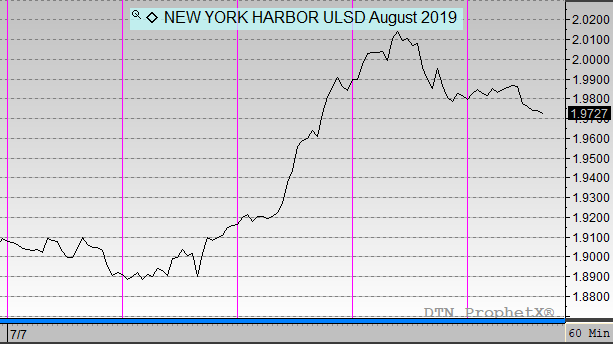

Diesel prices tracked crude higher as well, despite a seasonal inventory build. Prices opened at $1.9056, dipping a bit lower on Tuesday before climbing higher on Wednesday. Prices opened this morning at $1.9842, a gain of 7.9 cents (4.1%).

Gasoline saw more volatility than the other products, with even more bombastic gains, but those gains failed to keep hold. On Monday, gasoline opened at $1.9317 as the product leapt higher than diesel prices. Prices swelled over $2/gal for the first time since May, strengthened by the approaching Tropical Storm Berry as well as a moderate inventory draw. But with Berry expected to have just a short-term effect on the Louisiana coastline, gas prices are moving lower. This morning gasoline opened at $1.9895, just 5.8 cents (3%) above it’s Monday opening price.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.