All Eyes on Russia

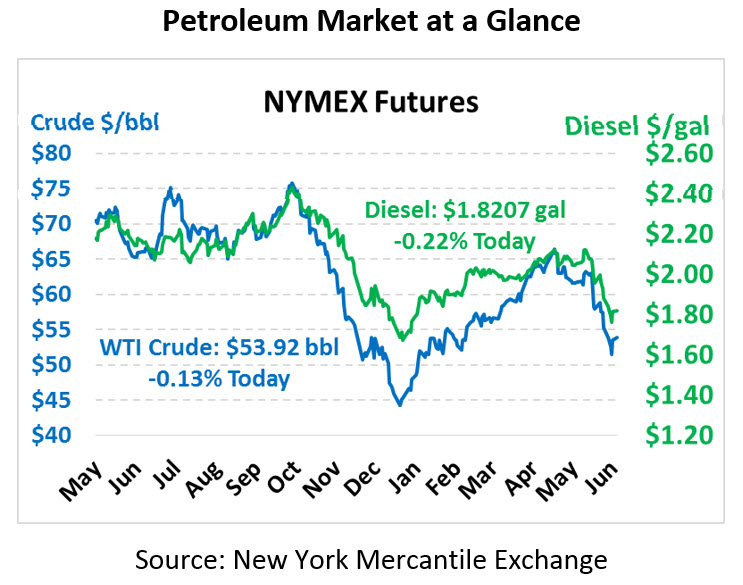

Markets are flat this morning after rising $1.40 on Friday, thanks to statements from Saudi Arabia that the OPEC+ deal will likely be extended. After briefly popping above $10/bbl on Mexico tariff threats, Brent-WTI spreads have cooled off to below $9/bbl, a sign that WTI’s prospects for the future have normalized relative to Brent. WTI crude is currently trading at $53.92, hardly changed from Friday’s close.

Fuel prices are mixed today, though both diesel and gasoline are close to flat. Diesel is trading slightly lower at $1.8207, a loss of 0.4 cents. Gasoline is trading up $1.7419, up 0.3 cents.

With just a few more weeks before the OPEC meeting to discuss extending cuts, markets are increasingly looking to Russia as the deciding vote on the group’s activity. Russia is the only member of the deal that appears undecided on extending cuts. While the country’s energy minister Alexander Novak noted that prices may potentially decline to $30/bbl without an extension, the country is also grappling with the geopolitical consequences of ceding market share to US producers.

In news closer to home, Mexico on Friday averted US tariffs by agreeing to increase National Guard presence at the US-Mexico border and to accept more asylum seekers from their southern neighbors. Trump did hint, though, that tariffs remain on the table if enforcement does not materialize in the coming weeks. Because Mexico is America’s largest trading partner, news that trade flows will continue unimpeded gave markets a hefty lift on Friday. For all the millennials reading: your avocado toast is safe, at least for now.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.