Biofuels – Good or Bad for Fuel Prices?

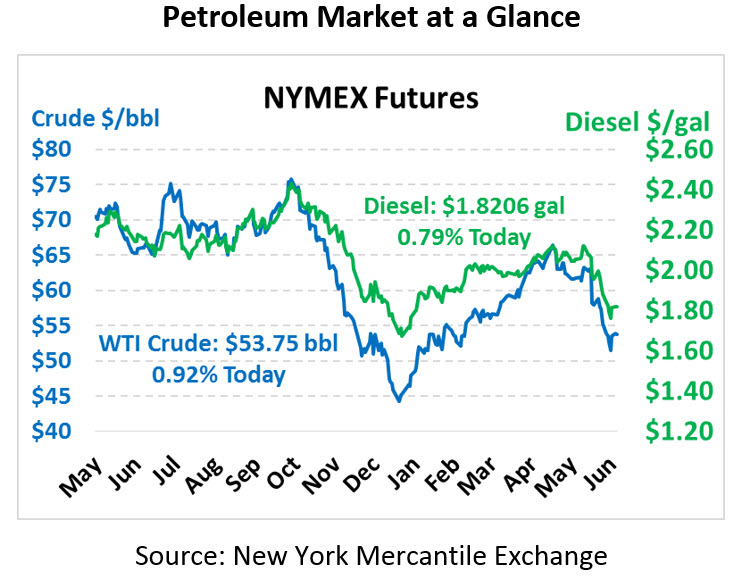

Oil prices are once again trying to inch their way higher after a moderate drop yesterday. Prices are up almost 1%, after falling a similar amount on Monday. Crude oil is currently trading for $53.75, up 49 cents.

Fuel prices are also on the rise today. Diesel prices are currently trading at $1.8206, a 1.4 cent increase. Gasoline prices are $1.7517, up 2.1 cents.

Market-driving news has been limited this week, with prices generally being driven by speculation on OPEC and trade wars. Several major agency reports will be released this week, starting with the EIA later today and followed by the IEA and OPEC later in the week. In general, markets expect these reports to show a growing imbalance of supply and demand in 2020, driven by weakened economic (and oil demand) prospects.

Amid the weakened economic prospects, one banking organization indicates that markets are pricing in a 2008-esque meltdown. Standard Charter’s head of commodity research Paul Horsnell noted that markets had “gone too far”, adding that the approaching slowdown will likely be far less severe than 2008. Their data indicates bearishness is at its lowest point since the aftermath of the Lehman Brothers collapse over a decade ago. If markets are truly poised to over-correct downward, it could present an opportunity for consumers to lock in low fuel prices for the year, assuming they put in the preparation early to assess their demand and establish an ideal price target. For more information on preparing, check out Mansfield’s risk management page and speak with an expert today.

Recent Biofuel Reports Draw Sharply Different Conclusions

Two major studies recently commissioned have come to starkly different conclusions about the effects of biofuels on energy prices.

In May, the Government Accountability Office released a report which indicated that biofuels have increased gasoline costs for consumers outside the Midwest due to higher transportation costs, and the effect on greenhouse gas emissions has been negligible. Specifically, the report highlighted roughly 5-8 cpg savings in Midwestern states, while states closer to the coast pay 2-8 cents more per gallon. The GAO report, though, has come under heavy criticism from the USDA, which pointed out that the GAO’s interview-style research methodology ignores the latest scientific research. The USDA further notes that the diverse panel of experts used by the GAO by design prevents a consensus on any major statement because experts are intended to provide rivaling views.

A second recent report by Dr. Phil Verleger, a prominent oil economist who has advised numerous political administrations on energy policy, draws the exact opposition conclusion. In line with numerous past studies, Verleger’s report concludes that the Renewable Fuel Standard had lowered gasoline prices for Americans by an average of 22 cpg over the past few years. Biofuels production over the past few years has been roughly 1 MMbpd, or slightly under 10% of American fuel demand. According to the report, had the RFS been curtailed in 2015, the cumulative impact of reduced fuel supply would have led to gasoline prices today of $4/gal, rather than the current $2.80-$2.90 national average. The cumulative effect has been a 0.5% increase in US GDP growth for the last four years – a huge boon for the economy.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.