Despite Iran, Stronger Dollar Creates Oil Headwinds

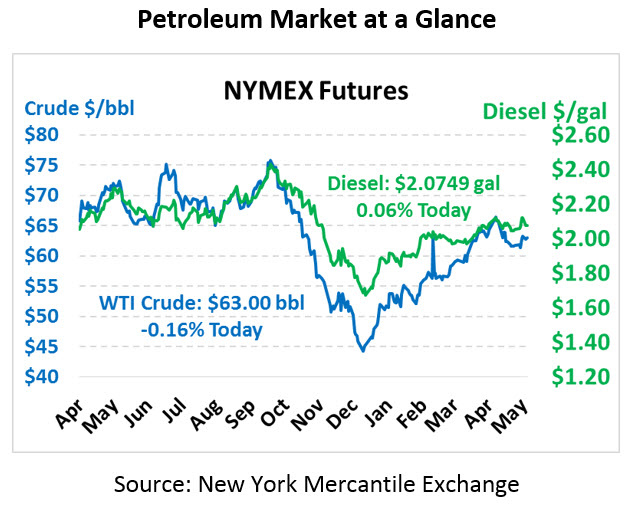

Oil prices are trading flat this morning as a strengthening dollar puts downward pressure on oil, even with Iran looming in the background. Crude oil is currently trading at $63.00, down a mere 10 cents.

Fuel Prices are trading moderately higher this morning, recovering from yesterday’s hefty dip. Diesel is currently trading at $2.0749, up a few points from yesterday’s close. Gasoline prices are trading at $2.0170, a 0.7 cent gain.

Federal Reserve Chair Jerome Powell spoke last night on the risks of corporate loans, highlighting similarities to the subprime mortgage crisis while noting more resilient institutions and close regulatory monitoring. He concluded the $1.2 trillion market for high-risk business loans does not constitute a threat to the US economy. Along with only moderate risk from corporate loans, Powell noted that tariffs are not likely to influence Fed decision making in the near future. His remarks helped allay concerns that interest rates might be cut, and the resulting gains for the US Dollar are creating headwinds for oil prices that have capped this week’s rally for now.

Despite economic news, it’s hard to look away from the Middle East right now – especially given aggressive tweets from Trump on Sunday afternoon saying that any military action from Iran would constitute “the official end” of the country. Iran has already announced their intentions to withdraw from the nuclear deal if other countries did not come through with economic support, meaning potential expansion of their nuclear activity. Iran has refused to negotiate under the context of economic coercion from the US, and Trump responded that the US had no intention of initiating talks until Iran was ready to negotiate. Expect this protracted conflict to weigh heavily on oil prices in the months to come.

Not quite as high in the headlines as US-Iran relations, Chevron yesterday announced plans to add electric car charging at select gas stations in California. The shift from Big Oil companies to more green alternatives like EVs and renewable power is certainly not new; oil majors invest heavily in R&D in these fields. This latest move is confined to California for now, which has been the clear leader in clean energy trends. California houses roughly half of the total US electric vehicle fleet, meaning other states are lagging far behind. Earlier this year, Shell became the first oil major to own a share of the EV space by acquiring a US-based charging company.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.