When Is a Trade War, Not a Trade War?

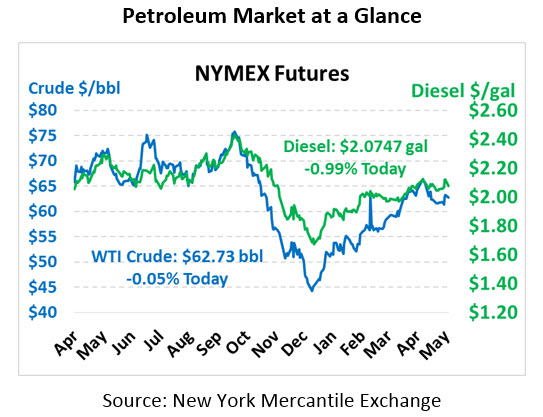

Markets are still uncertain of where to go following last week’s geopolitical drama, both in the Middle East and between the US and China. Crude this afternoon is trading at $62.73, hardly changed from Friday’s close.

Fuel prices are more bearish than crude, with both gasoline and diesel prices printing lower. Hefty crack spreads (the difference between fuel prices and crude prices) bid up last week are receding back towards more average levels. Gasoline is currently trading for $2.0127, down 3.5 cents. Diesel prices are $2.0747, shedding 2.1 cents from Friday. Merrill Lynch this morning noted that strong diesel crack spreads suggest diesel supplies are growing tight earlier than expected – well ahead of the uptick in demand expected later this year due to IMO 2020. With supplies already tight and record demand coming later this year, many analysts expect strong upward pressure on diesel prices.

Ray Dalio, one of the top hedge fund investors in the world, recently published an article about the US-China “trade war”, in which he argued that the title hardly fits the situation. Trade is merely the latest in an ideological dispute that pits Chinese values against American. While many hear “Chinese values” and think Communism, Dalio’s focus is on the broader cultural differences between the two countries driven by Confucianism vs. Western philosophy. For instance, the Chinese prefer wars in which superior size intimidates the enemy to surrender immediately, whereas Western powers have historically preferred escalating tit-for-tat exchanges.

Whatever the outcome of trade talks, it will not be the last in what will likely be a long-term ideological conflict between the world’s two largest economies. While there’s room for both countries to productively compete to create superior value on both sides, Dalio warns there’s also potential for the conflict to spiral into a “lose-lose war”. China, which is quickly modernizing and growing in global strength, will likely stall any outright conflicts until they are stronger, leaving the US to decide whether to force the issue in the short-term or not.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.