Oil Prices Set New 2019 High

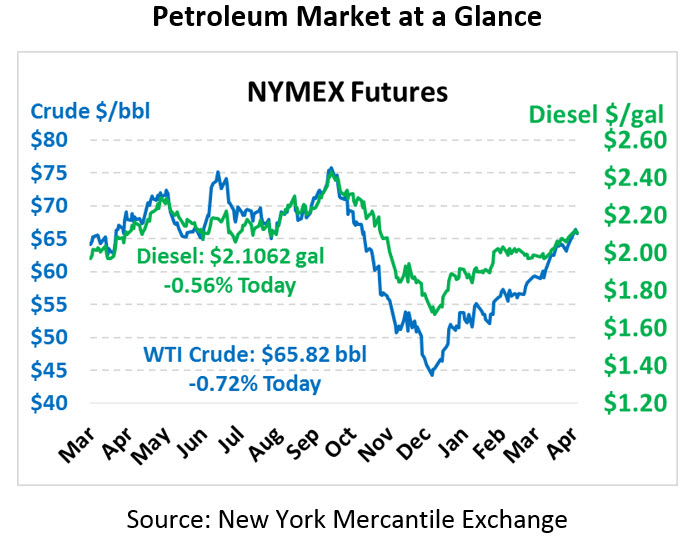

The oil complex is heading moderately lower after bearish API and EIA inventory reports. Crude closed at a new annual high yesterday of $66.30, but today prices are back below the $66 level. Crude is currently trading at $65.82, down 48 cents since yesterday’s close.

Fuel prices are also turning lower after setting new 2019 highs. Diesel prices are trading at $2.1062, down 1.2 cents since Tuesday’s close. Gasoline prices are $2.1139, down 1.8 cents.

The EIA’s reported showed a much larger crude inventory gain than markets expected, with a build 4 times higher than anticipated. Small draws in gasoline and diesel stocks were not enough to keep prices at yesterday’s high levels. The crude build comes as imports soared almost 1.2 MMbpd above the previous week. Imports have generally been trending quite low in recent weeks given sanction on Venezuela and Canadian output cuts, and since February imports have seen two weeks at 20-year lows (including last week). With imports back up to 2018 average levels, crude inventories swelled. A 2.4 percentage point uptick in refinery utilization wasn’t enough to offset the gain in imports.

Internationally, supplies are less bearish. Saudi Energy Minister Al-Falih indicated that the country would not deviate from cuts before Iran sanction waivers kick in, though the Kingdom does plan to increase production by 200-300 kbpd at that point. Still, any increases in production will only offset lost Iranian production; total OPEC production will remain at or below target levels. Venezuelan crude production reached 16-year lows – so low, in fact, that the country had to import oil for the first time since 2014.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.